How Solar Energy Became Cheap

A ladder of niches (and subsidies)

Solar has gotten remarkably cheap, falling in price by ~92% over the last 15 years and by ~99.8% over the last 50.

This is not news to anyone reading this, and most readers could likely rattle off the high-level drivers of this (e.g., some version of modularity / economies of scale / learning curves).

But I realized something recently: I have always focused on the right side of the chart, thinking ‘Now that solar is cheap, what can we do with it? How can we make it even cheaper?’

I didn’t think to ask the more basic question: Who on earth was buying enough solar panels at $100 per watt to get us down the learning curve in the first place?

‘How Solar Energy Became Cheap’ by Gregory Nemet tells that story1, and lays out a framework through which to think about other similar innovations.

The key was a ladder of niche markets, each providing the step-up in scale (and requiring a step-down in costs) that eventually created a world-beating technology.

Space, the first frontier

Like many mid-century technologies, solar photovoltaics in their current form were invented at Bell Labs. Building on early experiments from the 1800s using selenium, Calvin Fuller, Gerald Pearson, and Daryl Chapin developed the first practical silicon-derived solar photovoltaic (PV) cell in 1954.

In a way, it is no surprise that this breakthrough occurred in the same environment that birthed the transistor. Both relied on a p-n junction in doped silicon for their mechanism, and for much of the next 50 years solar PV would piggyback on progress in integrated circuits as computers and microchips became ubiquitous.

Initially though, the technology was wildly expensive (~$3,500 per watt in 2024 dollars) with no proportionally valuable use case.

Until the space race.

In 1957, the Soviet Union launched Sputnik 1, the first artificial satellite in orbit. Early satellites like Sputnik (and Explorer 1, the US’s first successful satellite) were powered by silver-zinc batteries. These batteries, though state of the art, were heavy and could only provide days worth of power.

In 1958, the US launched Vanguard 1, its second satellite and the first to include solar PV cells. Where Vanguard’s batteries depleted within 20 days of launch, its solar PV cells continued to power the craft for a full 6 years.

This difference in performance was critical, and solar PV quickly became the primary energy source of most spacecraft2, often in conjunction with onboard batteries. In parallel, the space industry became the largest customer of solar PV cells over the next 15 years.

As space applications continued to push improvements in cell efficiency, durability, and weight, solar PV started to see deployment in other niche applications like navigation buoys, rural telecom repeater stations, and offshore oil platforms.

This next niche beyond space allowed for a much wider diffusion of experience with the new technology, while providing demand for continued scale-up of production. These also provided the first (somewhat) cost-conscious buyers of solar PV. Where the space race had national pride on the line (and a parallel disregard for cost), other buyers for extreme applications were commercial enterprises, and valued solar’s reliability and relative-cost-improvement versus alternatives like stand-alone batteries or combustion engines.

These two niches marked the first phases of solar commercialization from the late 1950s to the early 1970s, but they weren’t enough on their own to move solar PV much down the cost curve. That would require larger terrestrial markets.

The oil crisis and technology-push

In 1973, the first Arab oil embargo3 showed just how vulnerable the US was to an external energy shock.

Suddenly, oil was expensive. This catalyzed policy support and government investment in a wide range of energy technologies to bolster the US against future shocks. This included the establishment of what became the US Department of Energy along with the launch of ‘Project Independence’ by then-President Nixon to relieve the US from reliance on external energy sources by 1980.

Solar PV was not a primary focus of these efforts, given its relative nascency and high cost. Those honors went to nuclear, coal, and synthetic fuel investments. Still, significant absolute resources were poured into solar PV research and scale up. The Solar PV R&D Act of 1978 provided for ~$1.5B over 10 years towards research into crystalline, thin film, and concentrating solar arrays, a strong boost for fundamental PV research.

On the commercialization front, one key US government effort was the ‘Block Buy’ program. Between 1975 and 1985, a series of 5 block purchases of solar PV with increasingly stringent specifications saw the price per watt fall towards $10, a valuable early example of government market commitment mechanisms.

In parallel, countries like Japan began to experiment with their own solar PV programs as part of their ‘Project Sunshine’. Solar PV was no longer just a US concern. Japan was also a subject of the Arab oil embargo, and was even more vulnerable due to its status as an island nation without significant domestic energy resources (e.g., coal, oil, gas).

This became suddenly relevant when the US stepped back markedly from solar PV following the 1980 election of President Reagan and the crash in oil prices in the early 1980s. Never again would the US lead in solar PV production, but the industry had taken root overseas.

Japanese industrial policy

Japan kept the light of solar PV alive through the 1980s and 1990s. As the US retreated, Japan drove a progression of breakthroughs and iterative optimizations as the country’s industrial companies, most notably Sharp, continued to push the technology forward.

This was a time of continued expansion into progressive niches: more buoys, lighthouses, oil wells, oil pipelines, railroad crossings, off-grid residences, pocket calculators.

Then, in the 1990s as the niche markets became increasingly saturated, MITI (Japan’s Ministry of International Trade and Industry) pioneered the first subsidies for residential rooftop solar. These programs were the first to explicitly focus on rooftop solar. They also introduced subsidies that declined over time, a pattern that has been copied by many subsidy programs since.

MITI also facilitated the adoption of net-metering of solar PV systems on residences, simplifying the process for households to interconnect and capture value from their solar PV systems.

Taken together this provided the next big jump in demand for solar PV and helped to establish it as an emerging mass-market technology. Vertically integrated manufacturers like Sharp stepped in to provide cells to this burgeoning market.

This was helped by parallel advancements in and explosive demand for silicon-based computer chips through the introduction of personal computers and the internet over the same time period. Even as solar PV increasingly established itself as an independent industry, it continued to be able to draw on the accumulated experience and equipment from the adjacent chip sector.

German demand shock

In the early 2000’s the Germans picked up the torch in a major way with the passage of their Erneuerbare-Energien-Gesetz (EEG) renewable energy law. First passed in 2000, this provided support for a range of renewable energy technologies, including feed-in tariffs that paid generators above-market market rates for the energy they produced.

Strengthened in 2004, this law supercharged the adoption of rooftop solar. Per Nemet, “these revisions sparked the EEG’s ‘gold rush moment’. Installations grew by a factor of four from 2003 to 2004 and transformed the industry.” The policy would catalyze over 30GW of installations between 2004 and 2012 (at a cost of over 200 billion Euros, or ~5000 Euro per German household).

This scale pushed solar PV into the mass-market, with equipment manufacturers developing specialized production equipment specific to solar (not modified from computer chip production). To help cater to the booming demand for solar PV, equipment vendors even went so far as to develop and market ‘turnkey’ solar PV production packages. These deployments, supported in commissioning and training by the vendors’ technical staff, helped new entrants quickly join the fray as panel suppliers scrambled to meet demand.

In fact, demand grew so quickly that German and Japanese solar PV suppliers couldn’t scale up fast enough to meet it, ceding market share to new Chinese rivals like Suntech. These competitors leveraged equipment manufactured in Germany to undercut German solar PV suppliers through lower costs and an ability to scale up more quickly.

When the financial crisis came in 2008, Chinese government support for the solar PV industry helped indigenous suppliers continue to grow and expand just as their German competitors saw a capital crunch.

Framed as Germany’s ‘Gift to the World’, the EEG was modified in 2012 to be much less generous to solar PV. By that point Germany had catalyzed a transformation in solar PV from niche to mass-market, while leadership once more passed to a new country.

Chinese hegemony

And now we get to the part of the story that most people already know.

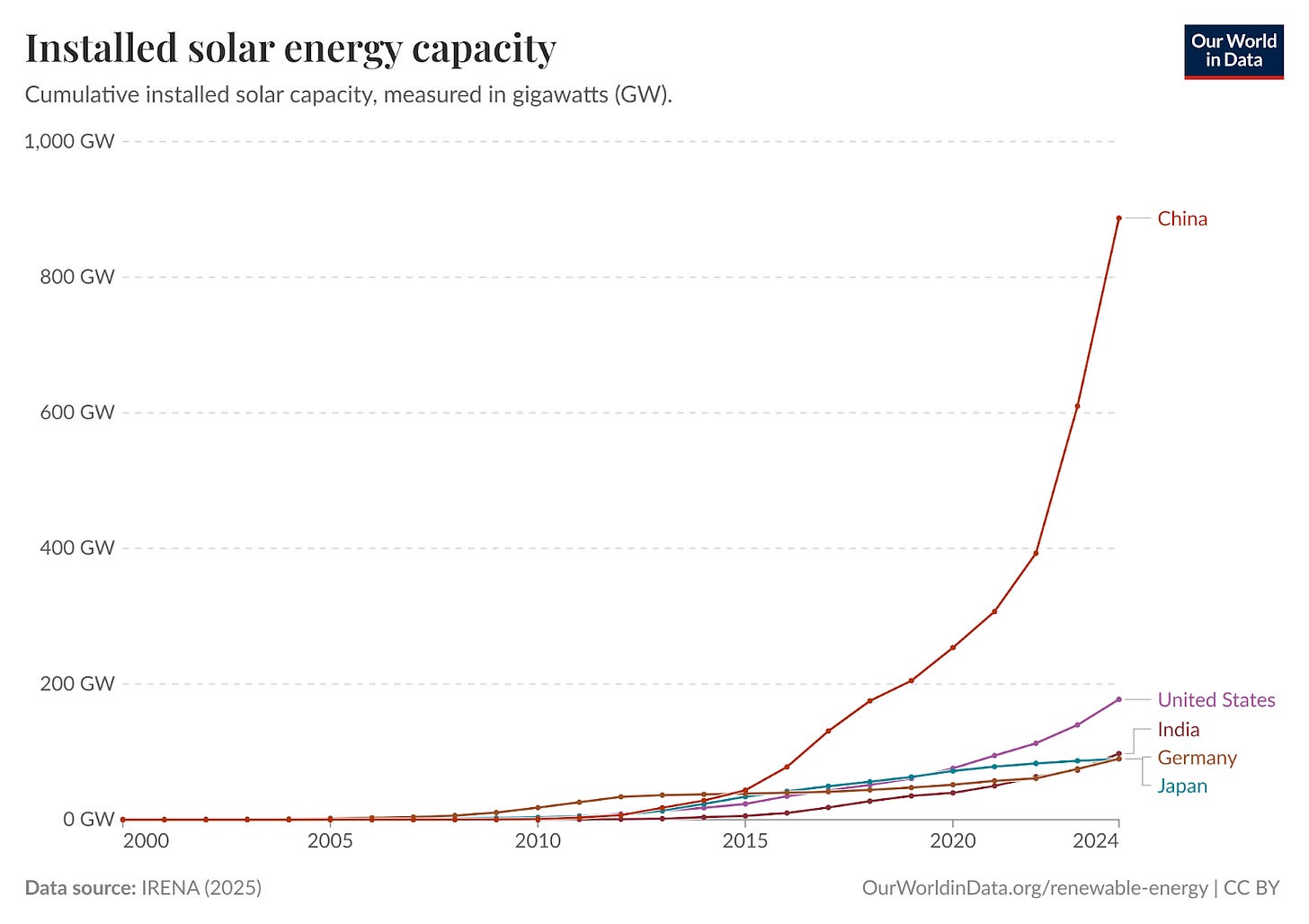

Over the last 15 years, costs have continued to tumble down as the solar PV industry has become increasingly concentrated in China. From silicon production through module assembly, the Chinese solar PV supply chain is robust, specialized, and efficient, cranking out more solar PV modules in 2024 than the entire industry between 1975 and 2019 (~588GW versus ~580GW).

And this production has not just been for export. China has also been the most prolific installer of solar PV capacity, in part thanks to its own feed-in tariff first introduced in 20114.

This sustained growth has created a truly global market for solar PV, with cost reductions creating fast-growing markets in countries like India, Brazil, and Pakistan, and empowering solar maximalists to shift the Overton window towards a solar-powered society.

Recognizing the strategic importance of solar PV, countries like the US have sought to protect their own domestic solar industries through tariffs and tax credits. This has caused some production and assembly to shift back or to other countries in southeast Asia like Vietnam, but the center of gravity for the industry remains in China with little signs of that changing.

Takeaways

So to recap, who was buying all those solar panels?

US - space (1960s) and R&D (1970s)

Japan - industrial niches (1970s to 1990s)

Germany - mass-market (2000 to 2012)

China - global market (2004 to present)

Where else has this pattern repeated?

In a way, this is an industry-level version of Clayton Christensen’s theory of disruption. Start with a product that performs poorly on existing competitive dimensions (e.g. cost per unit of energy), but outperforms on something critical (e.g. weight and longevity for solar PV in space). Leverage that differentiated advantage to grow volumes and bring down costs. Rinse and repeat until you’ve taken over the world.

One of the most well-known examples from an adjacent industry: Elon Musk’s ‘Secret Master Plan’ for Tesla released in 2006.

In it, Musk outlined how Tesla would use its Roadster to serve the niche, high-end market for sports cars with high torque electric motors that could beat cars like Porsche and Ferrari. From there, they would move on to a more mainstream 4-door vehicle (which became the Model X and Model Y) before ultimately releasing a mass-market vehicle (the Model 3)5.

This iterative progression from niche to mass-market enabled Tesla to become the largest EV manufacturer in the US, even if its global leadership is now being eroded by Chinese competitors.

In this context, the path for solar PV from invention to world domination seems remarkably contingent, with the industry swinging from country to country even as costs declined steadily and volumes grew. It’s amazing that it happened as quickly and steadily as it did.

In contemplating the lessons from his own book applied to Direct Air Carbon capture (DAC), Nemet bemoans the 70 years it took for solar PV to get to today. But it’s not clear how much a perfectly calibrated technology-push and demand-pull approach can accelerate this iterative process, even if the need for climate action is as urgent as many believe.

The challenge is applying the recipe to ‘commodity’ markets like energy and carbon capture.

Jumping too quickly to scale can end in tears, as the Cleantech 1.0 boom and bust showed.

In this sense, the framework can also provide a useful razor to evaluate emerging technologies. Those with a clear ladder from niche to mass markets may have a shot, those trying to jump straight to mass market are taking a riskier, more binary bet.

Among nuclear fission startups, for example, this lens would favor folks like Antares and Radiant Industries targeting micro-reactors for military and off-grid applications, or mid-scale players like Last Energy (~20MWe) or Aalo Atomics (~50MWe) targeting datacenters. Others like Terrestrial Energy (~380 MWe) or NuScale (~924MWe) are more likely to struggle since they can’t help but compete immediately with existing mass-market alternatives.

For DAC, it’s not obvious there is a natural niche buyer equivalent to the industrial niches that powered solar PV beyond space applications. Highly-interested corporate buyers like Microsoft and Stripe can create a flourishing of early stage startups, but without the next tranche of buyers the market will falter. Taking this lens, it may make more sense to bet on technologies that serve industrial CO2 users first with a clear path to broader use, even if they can’t immediately scale up to a million tonnes per site.

Simple isn’t easy and laddering up from niches to world domination is no surefire thing, but at least it’s possible as shown by the growth of solar PV over the last 70 years. That said, the path will likely take longer than many hope, particularly for climate technologies, and investors and operators should orient around milestones and markets on the way to their bright vision, lest they come up empty-handed.

Further reading:

How did solar power get cheap? - Brian Potter

Where not specified, quotes and figures that follow are from the 2nd edition of the book released July 2025.

Larger manned craft like the Apollo missions used a combination of batteries and fuel cells for power.

A response to the US’s support of Israel during the Yom Kippur war.

This has recently been phased out. It will be interesting to see how that impacts the trajectory of Chinese solar installations over the medium term.

If you’re wondering why it’s the Model 3, now you know. It was the 3rd car in the Master Plan, even if it was the 4th car that Tesla released.