Grid defection is coming to California

Energy independence and utility death spirals

A decade ago, a specter haunted Europe.

No, not Communism; utility death spirals.

Utilities were faced with growing legions of subsidized rooftop solar customers who weren’t paying enough into the grid to cover system costs. Some were even leaving the grid entirely (otherwise known as grid defection). Their share of system costs would then fall on non-solar customers, causing more people to switch until the utility’s business had been irreparably eroded…

Except this didn’t come to pass, mostly because defecting proved too costly for customers once regulatory supports were reduced.

Rooftop solar was relatively expensive, and only produced power during the day. Batteries to make the system work 24/7 were even more expensive. Regulations were restructured to avoid unduly favoring renewables. As a result, regulators and utilities mostly stopped worrying about grid defection and utility death spirals.

But Hollywood loves a sequel, and the specter of a utility death spiral has returned to haunt California.

In fact, for some households grid defection is currently the economic choice. If recent trends continue, it will only become more viable for more households over the coming years.

The time is now ripe for Californians to start leaving the grid.

On one hand, this has potentially dire implications for local utilities. Grid defection at scale makes a utility death spiral increasingly likely.

On the other hand, this is an exciting moment. The cost of renewable energy has gotten so low, and the efficiency so high, that a household can reasonably cover its needs from onsite generation alone. No more power outages, no more rising utility rates or impenetrable bills, just clean steady electricity from the sun in the sky (and the battery in your garage).

True energy independence is within reach for many Californians.

Why now and why California?

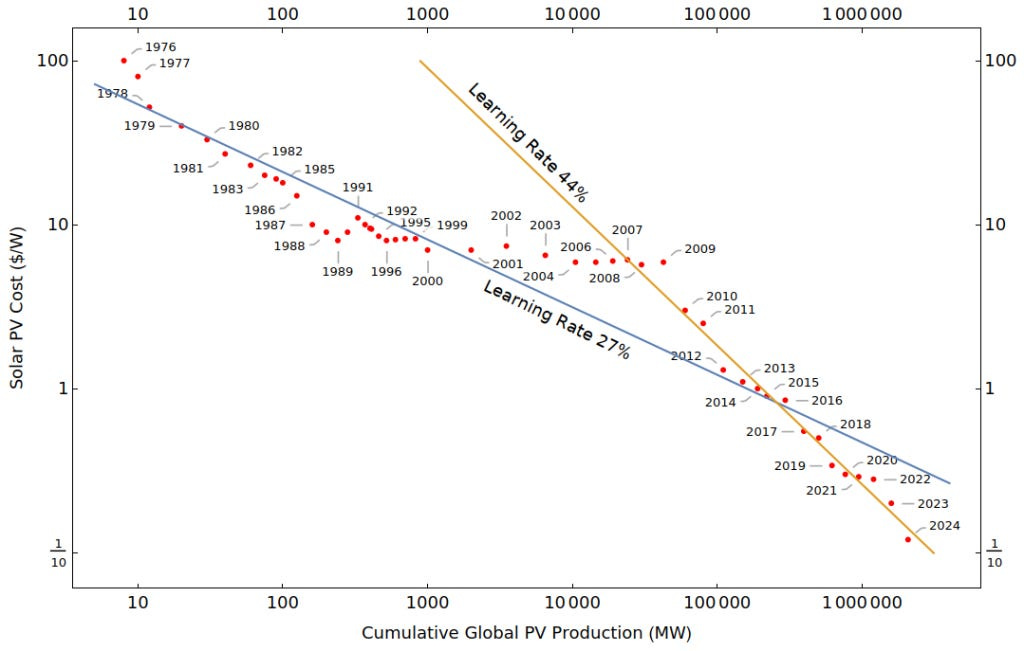

The price of solar photovoltaic (PV) modules—the panels in a rooftop solar system—has fallen dramatically as global production has ramped up.

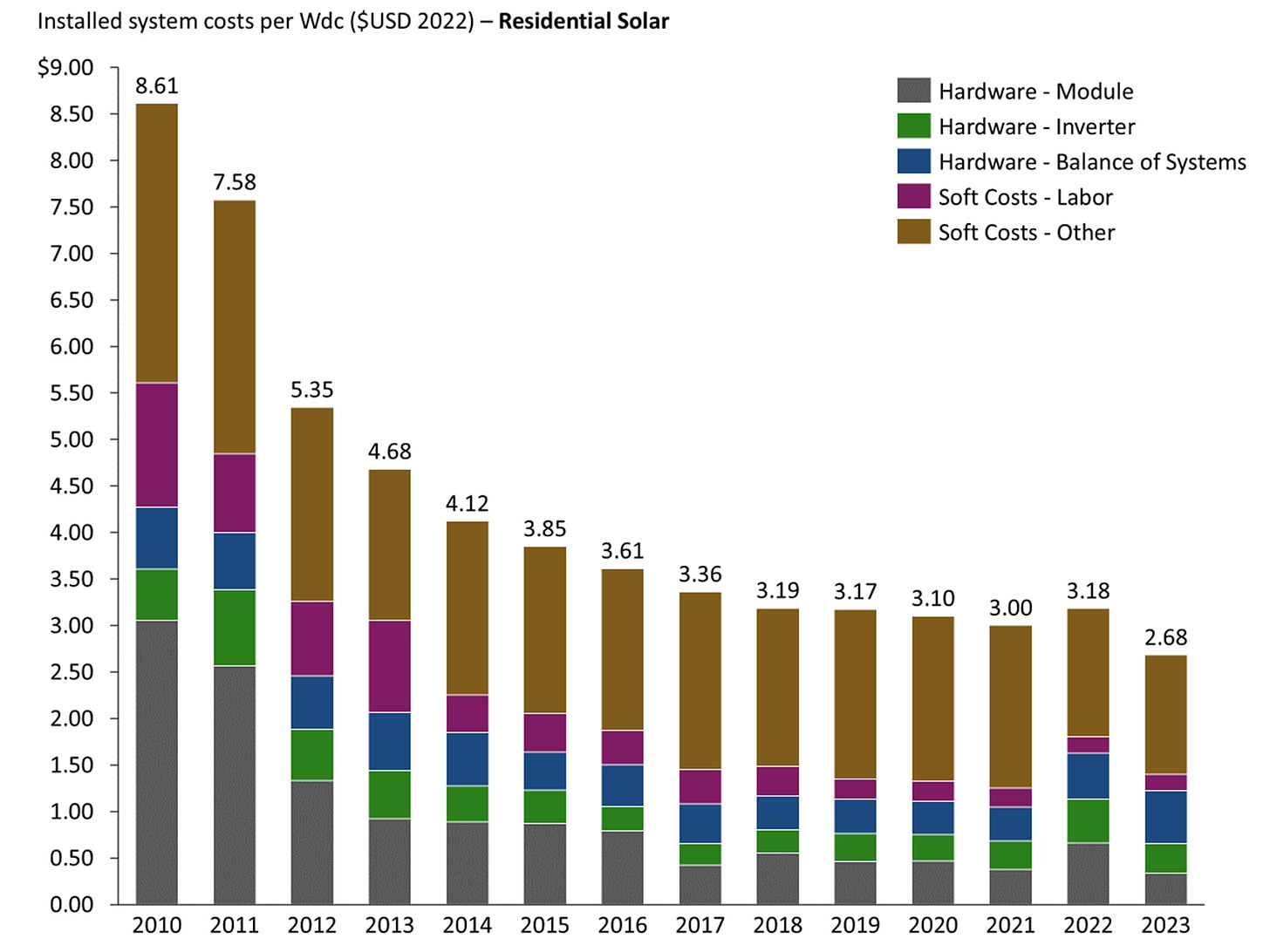

Residential solar prices have fallen alongside (albeit not as quickly due to the large drag from soft costs like customer acquisition, which I dug into here).

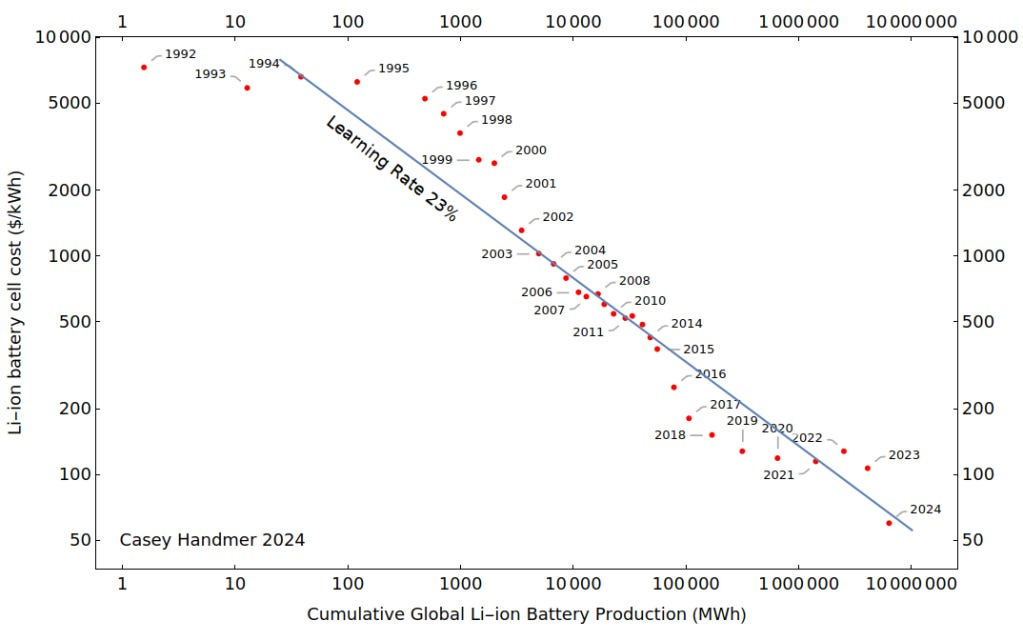

Battery cell prices have also dropped dramatically, though that hasn’t yet fully translated to a drop in final installed costs for residential customers.

While solar costs are going down, residential electricity prices have been going up, particularly in California.

Importantly, these are nominal dollars1 so this includes broader inflation. But that makes the drop in solar and battery costs even more impressive. They have been dropping even through increases in the overall price level. Utility rates, however, just continue to rise.

In fact, California now has some of the highest residential electricity prices in the country (highlighted in red below).

At the same time, California is rich in solar resources. In the below map—which shows solar irradiance that reaches a horizontal surface from direct, refracted, and reflected light—California is at the left end of what is effectively a solar bullseye in the US southwest. In the red areas, more output is possible from a given set of solar panels.

Other states in the southwest have lots of sun, but their current electricity prices are low enough to beat off-grid setups. Some in the northeast have high electricity prices, but their (relative) lack of sun make them less appealing for solar-backed grid defection (though they could be next as equipment prices come down.

Taken together, we see that California has a unique combination good solar resources (high solar irradiance, shorter stretches of cloudy days) and high electricity costs that make it a prime target for grid defection

Interestingly, Hawaii will likely face the same defection, but right now its island location makes the cost of solar and batteries more expensive, and its solar resource worse2.

It's important to note that expensive electricity isn’t necessarily the fault of California’s utilities. In recent years they have had to deal with a lot, including:

High cost of natural gas generation due to limited local gas production and pipeline access

Aging equipment and systems that were built out rapidly in the post-war years

Rapid return of load growth (growth in demand for electricity) from electrification

Increasing wildfire risks, and increasing costs associated with mitigating these risks

Increasing climate risks from flooding and heat3

Challenges hiring and retaining craft labor (e.g., linemen) in key metros due to rising cost of living4

Explosion of grid planning complexity and interconnection study volumes in the face of all of the above

These are all hard to deal with, particularly when utilities are constrained by a century of regulation and (justifiably) conservative operating cultures.

But customers don’t really care. They just want cheap electricity that comes out of the wall when they expect it. If there is a better and cheaper option, people will choose that.

The household economics of grid defection

It can be easy to talk in sweeping abstractions about straight lines on graphs. Let’s talk about a specific household to illustrate the dynamics at play.

If you don't want to follow along with the math, the short answer is: going off-grid in CA can make sense today if you want to buy the system outright, but doesn’t yet make sense to finance, consistent with recent academic findings.

Similar to my previous article on solar net billing, I’m going to use a house in Temecula as a proxy for the type of ‘SoCal suburbs house’ that is a prime customer for solar + storage (and since we need a physical site for the solar resource estimation, which I’ve done using NREL’s PVwatts API5).

Against this, we can draw normalized hourly load data from Southern California Edison for 2023 for a single family residence. The annual demand is ~6,200 kWh, or ~17 kWh per day, which we’ll be aiming to power on an hourly basis across the year.

To serve this load, we will build a system comprised of three things6:

Rooftop solar panels: ~$2,300 per kilowatt of capacity

Stationary battery storage: ~$1,000 per kilowatt-hour of capacity, charged by the rooftop solar

Backup storage / generation (either a diesel generator or an EV with bi-directional charging): ~$2.50 per backed-up kWh

For our system, we’ll look at 3 scenarios: a baseline built on the unaltered hourly load data, and two scenarios that include added electric vehicle charging load (given the ongoing shift to EVs) with different times for charging (day or night). Additional key assumptions are outlined in the footnotes7.

How much will this off-grid system cost?

Running a quick optimization, we get the following sizes and costs:

First, note that these systems are expensive! The absolute cost (before subsidies) is pretty large, on par with a new car or moderate home renovation. This is why ~70-80% of systems are financed or third-party owned.

Second, these systems aren’t that big in the context of a normal residential solar installation, which averaged ~7.4 kW in capacity in 2023 (per Lawrence Berkeley National Lab). Our off-grid systems are overbuilt relative to the expected load, but we wouldn’t expect issues fitting the needed solar panels on most roofs, or putting the batteries in most garages. The big difference in going off-grid is the inclusion of larger batteries.

Finally, a single EV adds a lot of load above our baseline, and the timing of its charging is pretty important to the overall system design. While charging at night is fine for grid-connected EVs, charging during the day (while the sun is shining) is much more efficient for our off-grid system. This makes specific customer behavior important to the final decision on defection.

But how does all this compare to what we might pay to the local utility?

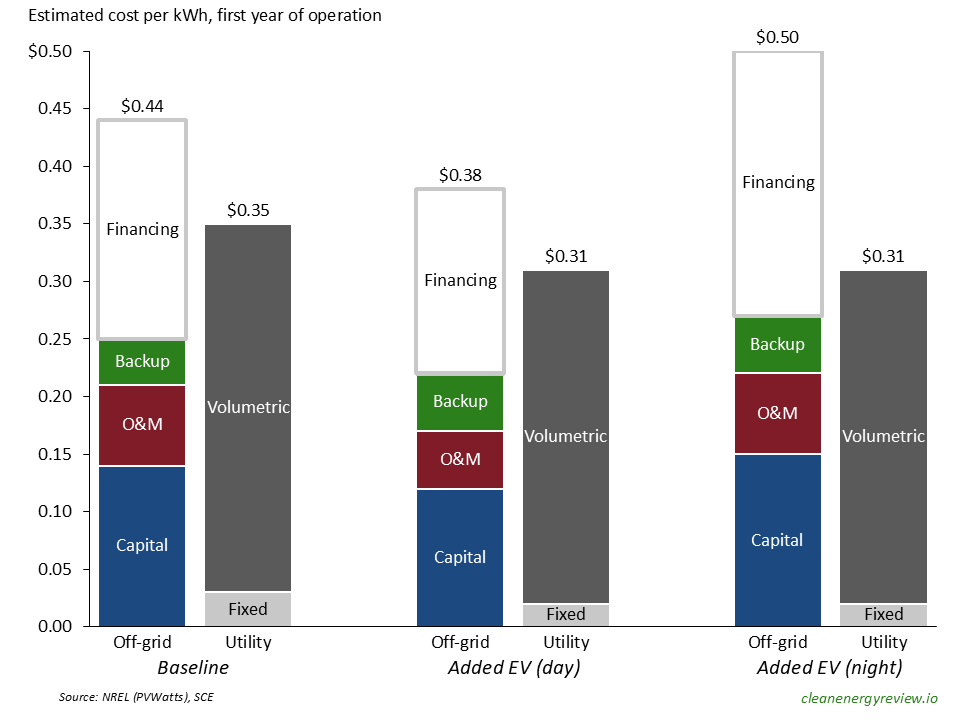

Below we can see the cost-per-kWh across our different scenarios, with the height of the bars representing the cost per kilowatt-hour for energy during the first year of installation8. The off-grid costs are shown in blue/red/green/white and the utility costs in grey.

The cash costs in blue/red/green are lower than the utility costs, so if you’re angry with your electric utility and have some spare cash lying around, go off-grid! You can likely see bill savings today.

But around 80% of residential solar + storage systems aren’t bought outright, they’re financed. Once the cost of financing is included (the grey outlined box, based on financing rates of 8%), it isn’t economical to go off-grid just yet.

This is consistent with recent research from Western University that finds economic grid defection viable in multiple California locations before accounting for financing costs.

This level of cost parity is enough to entice some to switch, but likely isn’t enough to start a wave of defection.

Can this change in the near future?

Imagine that over the next 3 years, utility rates continue to grow at their recent historical trajectory of ~3% per year above inflation, battery costs come down to ~$600 per kWh, solar PV costs fall to ~$2,000 per kWh, while financing rates fall to 6.5%.

Then we end up with the following:

Going off-grid becomes immediately economical, and would only become more attractive as utility prices keep marching up9.

In this scenario, our model homeowner could expect to save ~$15,000 over the 25 year life of their system by going off-grid.

Is it realistic to expect such a future?

I’m most confident in the coming battery price declines. $600 per kWh is what you’d pay for the battery in a new Tesla Model 3 (and you’d get the car for free10). Cell prices for lithium iron (LFP) batteries are approaching $50 per kWh; installed battery prices are going to come down.

We’re already starting to see this with Tesla’s Powerwall 3 expansion units. These 13.5 kWh units rely on the inverter in a lead Powerwall 3, allowing them to avoid duplication of equipment for larger systems with multiple battery units. With this simplified architecture, these add-ons are priced at ~$500 per kWh (before installation).

The cost of solar PV should also come down, but at this point the panels themselves make up a minority of total costs. Bringing down soft costs will be slower, particularly given the challenges in early customer acquisition for an off-grid system.

For reasons already mentioned, utility rates are likely to rise at the level of inflation or above. The appeal of off-grid systems will hinge on how much ‘above’ those rate increases end up being. Increases consistent with the last few years will quickly bring off-grid systems into viability; only sustained price discipline will keep this risk at bay.

The path of interest rates is hardest to forecast. Rates have come down from recent highs, but it’s not obvious where they will settle. Much will depend on the policies of the incoming Trump administration.

Each of these factors will impact the speed at which grid defection will occur. But the overall trend is clear.

Who will shepherd Californian’s to energy independence?

Sunrun and Tesla

Residential solar companies like Sunrun and Sunnova are built to sell and service residential energy systems, and I expect them to lead the broader rollout of these off-grid systems once the economics work11.

Sunrun in particular already sells most of their systems as part of a subscription. Once that subscription (and the underlying system) can cover all of the energy the customer needs, it may not make sense to pay for a grid connection anymore. The subscription model also allows Sunrun to take advantage of Investment Tax Credit (ITC) Adders that further reduce the effective system cost.

I expect them to start with their existing customers (for which they have extensive data and a pre-existing relationship), piggybacking on a repowering12 or system upgrade to go off-grid entirely.

These efforts will be boosted by the broader adoption of bi-directional charging capabilities for electric vehicles (EVs). When paired with the right equipment, this allows an EV to power a home just like a stationary battery might. This can significantly expand the effective battery capacity of a system, either reducing the cost (by allowing a smaller stationary battery) or eliminating the need for a backup generator13.

Right now, this capability is only really found in a few trucks like the F-150 Lightning and the Tesla Cybertruck, but the expectation is that additional models with bi-directional charging are coming in the next few years (potentially alongside code refinements in the 2026 National Electrical Code to formalize rules around this).

On this front, I expect Tesla to lead. They have the vehicles, and an existing home energy business from their SolarCity acquisition. They are well-placed to orchestrate an off-grid shift, and I wouldn’t be surprised to see Musk pitching homeowners on a path to energy independence.

Tesla Powerwalls are already being used in off-grid-ready systems like the one shown below.

Once either Sunrun or Tesla start to offer off-grid systems at scale, the rate of grid defection will accelerate markedly.

California grid defection: when, not if

So, we’ve established that economic grid defection is already possible in California on a cash basis. As solar and battery prices continue to fall, and utility rates rise, this will only become more appealing over the next 5-10 years. It is a matter of when, not if.

On the question of when, there are a number of factors that could slow the arrival of household energy independence, including:

Increases in interest rates: The effective cost of off-grid energy is heavily dependent on the cost of financing. Any increases in interest rates will make these systems disproportionately costly relative to utility rates14.

Tariffs / tax credit reductions: On the campaign trail, Trump and his team talked extensively about increasing tariffs on foreign-made goods and removing parts of the Inflation Reduction Act (which provides generous tax credits to solar PV and battery projects). If these changes come to pass, this would significantly alter the economics of going off-grid.

Other regulatory changes: Once it becomes clear that grid defection is a serious risk for local utilities, I expect there to be some sort of regulatory response (positive or negative).

One potential avenue: air quality regulations. California regulates the use of installed diesel backup generators15 if grid power is still on, but it’s not clear how this applies to homes without a grid connection. It wouldn’t be hard to make one kind of off-grid system design illegal for ‘air-quality’ reasons, though this wouldn’t preclude homes from using a bi-directional EV for backup.

The interesting wild card is consumer appetite. While I’ve centered the arguments for defection around economics, for many people there are other considerations.

For some, there is clearly appeal in independence and self-sufficiency; these are deep-rooted American values after all. Homeowners frustrated by ‘public safety power shutoffs’ every Thanksgiving16, or worried about a multi-day outage following a major earthquake, will be more willing to buy some peace of mind with an off-grid system. Decreasing prices make this option more available to more people.

On the other hand, many will see risk in an off-grid system. Going off-grid shifts electricity from something that is (basically) always available (even if expensive) to something they need to think about. No amount of probabilistic weather modelling will overcome some people’s anxiety about a long stretch of cloudy days, in the same way that some have ‘range anxiety’ around electric vehicles, even if they only ever take short trips.

This will be overcome eventually, just as range anxiety has been allayed by larger EV batteries and more numerous charging stations, but expect early adopters of off-grid systems to be embracing adventure and independence as much as they are seeking lower power bills.

The future rests on California homeowners

What happens to our existing utility system once grid defection gathers pace?

Honestly, I’m not sure.

In many discussions of utility death spirals, much hinges on the elasticity of consumer defection. Say 10% of customers leave, and half their costs are fixed and get piled onto the customers that remain, making the latter’s bills go up by ~5.5%. If that’s a big enough increase for the next tranche of customers to leave, then they will, and the spiral continues. If not, then the system stabilizes at a new equilibrium.

This is now complicated by ongoing price declines in solar and battery equipment. The current process doesn’t rely on a feedback loop with utility rates to cause people to defect. To the extent that the systems keep getting cheaper, more people will leave each year whether or not the death spiral effect holds.

This makes defection hard to stop among those with the resources to leave.

But there is a limit to this process. Some people and businesses will not be able to leave at an acceptable cost, for example because they lack the space for enough solar panels to cover their demand.

An optimist might argue this group is large, and that grid defection will ease load growth pressure on the distribution grid. This will free up capacity to provide more energy to these remaining customers, growing total energy usage overall.

A pessimist would predict a slug of stranded customers paying swollen bills17 to keep the remaining grid infrastructure operational after everyone else defects. This would fall disproportionately on urban residents and commercial customers; large industrial customers would move18.

Ultimately, this is an empirical question. Over the coming years, we’re going to find out which is right. My hope is that California’s utilities and regulators rise to the challenge, and this strengthens the system as a whole. If not, the long-term impacts are decidedly murkier.

In their last energy crisis, Californian’s recalled their governor. Pacific Gas & Electric has already gone bankrupt once from wildfire damage. Should it come to pass, the disruption from grid defection could prove more painful than either.

For individual homeowners though, the future is bright. Thanks to the declining cost of solar panels and batteries, they can seize true energy independence for themselves. Over the coming years, I expect many Californians will do just that.

Further reading:

S Sadat, J Pearce (2024): The threat of economic grid defection in the U.S. with solar photovoltaic, battery and generator hybrid systems

Navon et. al (2023): Death spiral of the legacy grid: a game theoretic analysis of modern grid defection processes

Rocky Mountain Institute (2014):The Economics of Grid Defection

For those that are really bugged by this, US electricity prices have been roughly flat for the last 10 years after adjusting for inflation. California power prices are up ~40%.

The solar resource varies a lot across the islands, but in general people live in the parts that tend to be rainier and cloudier, not at e.g. the top of Mauna Kea.

Extreme heat can cause transformers to get outside their thermal operating limits, requiring either proactive replacement (to larger, more heat tolerant equipment) or increased reactive replacement (due to accelerated failures).

These roles are almost all unionized with specified pay scales. The same pay will go much further in suburban and rural districts than in expensive urban centers, making it harder to retain people working in the latter.

Importantly, this uses a ‘typical meteorological year’ which trims extreme outliers. On the margin this could underestimate the volatility in power production from our solar panels, but should be sufficiently correct for our purposes.

I am simplifying away the balance of system equipment and inverters / EV charging equipment. Their costs are not answer-changing for the system costs.

System life: 25 years; battery replaced in year 13 at 50% initial cost.

Roof tilt: 20 degrees; azimuth: 180 degrees (due south)

TMY: National Solar Radiation Database (nsrdb) for Temecula, CA

Solar PV system losses: ~14%; inverter efficiency: ~96%; battery roundtrip efficiency: 85%

Solar PV O&M: $20 per kW-year; battery O&M: $20 per kWh-year

O&M cost escalator: 2.25% per year; utility cost escalator: 2.25% per year

Tariff: SCE TOU-PRIME

ITC: 30%; assume tax burden sufficient to claim in year of installation; no domestic content or energy community adders

EV: Drives ~40 miles per day, getting ~3.9 miles per kWh (consistent with a Tesla Model 3). Day charging happens between 10am and 3pm. Night charging happens between 1am and 7am.

In some ways, the year 1 costs are an unfair comparison point because the LCOE across the system life will be much more competitive with the utility (which is expected to see costs grow over time). But people want to see savings right away, so I’ve focused on year 1 costs here.

Some people refer to residential solar (off-grid or not) as a hedge against rising utility rates. By getting at least part of your electricity from a source you control (and one with relatively fixed costs), you are less exposed to utility rate increases.

I would be very surprised if they haven’t already run this analysis based on their existing customers (with more rigor to boot). They have actual customer energy usage (not just an example house) along with specific knowledge of roof dimensions, solar resource at a site, etc. Pair this with their more detailed tariff modelling, and they would be able to much more specifically identify if a given home is better served off-grid.

Generally, replacing aging modules to extend the life of a solar PV system.

In times of low solar production, you could go charge up at a charging station and bring the energy back to your off-grid house. Though this still relies on the grid in some sense, your household wouldn’t have an ongoing relationship with the utility.

While this financing cost increase would also affect utilities, which generally carry a meaningful debt load, their cost structure is much less leveraged overall than a new solar + storage system.

This is one reason that backup systems like those from Enchanted Rock are appealing. Because they use natural gas reciprocating engines (not diesel), they comply with stricter air quality rules and can operate to provide grid services during times of peak load.

Public safety power shutoffs (PSPS) are undertaken during dry summer and fall months when elevated fire risk from high winds make operation of the affected power lines too dangerous. In recent years, the fire season runs until December with the first rains, and so these PSPS events have had an unfortunate likelihood of falling during Thanksgiving. PSPS events tend to be focused on the highest risk lines in high wind areas, and so the same homeowner might see multiple events in a year (though the utilities are working hard to reduce this frequency).

Or else see the costs fully socialized by the state.

Either to a part of the state where they can go off-grid, or a state like Texas with low power costs. Most already have, with California industrial electricity use per capita a fifth of that in Texas.

Nice analysis!

Do you have a sense for why exactly the economics are shifting toward grid defection making sense? For example, I could image that:

A) In an era of cheap solar + batteries, it simply does not make physical sense to connect suburban houses to a grid

B) The grid is not being operated efficiently (operators are too conservative / have bad incentives / are hamstrung by permitting challenges / etc.)

C) Utility prices are inflated by the need to pay off past debts

D) Other (or a combination)

But I have no idea which of these are correct.

The cost of grid defection changes dramatically as soon as EVs are set up with bidirectional charging. This article assumed $1,000/kWh for battery storage, but an EV with an 80 kWh battery (Chevy Equinox) sells for under $40,000, so $500/kWh with a free car thrown in. If you can run the car from the house, and the house from the car, you gain a lot of flexibility. If you run short of power, you zip down to Walmart and charge up the car, bringing 5 days of power home with you.

I just bought a 100AH 12V LFP battery on TEMU for $129 -- $100/kWh. Take a third off the capital costs in the table above, reflecting current battery costs, and the economics of grid defection become compelling today, not tomorrow.

See: https://energycentral.com/c/um/big-batteries-electric-vehicles-will-accelerate-grid-defection-solar-customers