The Uber-ization of electricity

How DERs are ushering in a new grid paradigm

Before Uber, taxis were all we had. They operated on a fixed rate model, with the same metered fare if it was a sunny holiday morning or raining during rush hour. This drove prices up and kept drivers circling for fares, only to leave taxis hard to find at any price during peak periods.

Uber changed this. By recruiting drivers outside the regulated taxi structure, and implementing surge prices during periods of high demand, they were able to flex supply to better match demand. Their app-based platform also gave riders much improved transparency into the price they would be paying, and the expected length and route of their ride.

The result: a revolution in intra-city transport that is still reverberating.

We are at the beginning of a similar revolution for the electric grid.

In my last piece, I talked about how the infrastructure of the grid is built around peak load. This is the equivalent of taxis constantly circling just in case there’s a sudden storm, with all the attendant cost that entails.

Today we’re going to talk about how distributed energy resources like EVs and batteries will disrupt this model—and how a flurry of new businesses are seeking to capitalize on the opportunity.

First, a quick recap on the problem to be solved.

Electricity is vitally important to modern civilization, and Americans get very angry when their power goes out or if it’s more expensive than expected.

This makes life hard for grid operators and utilities, because demand fluctuates a lot hour to hour and season to season. There are extreme spikes in demand that must be handled by the grid.

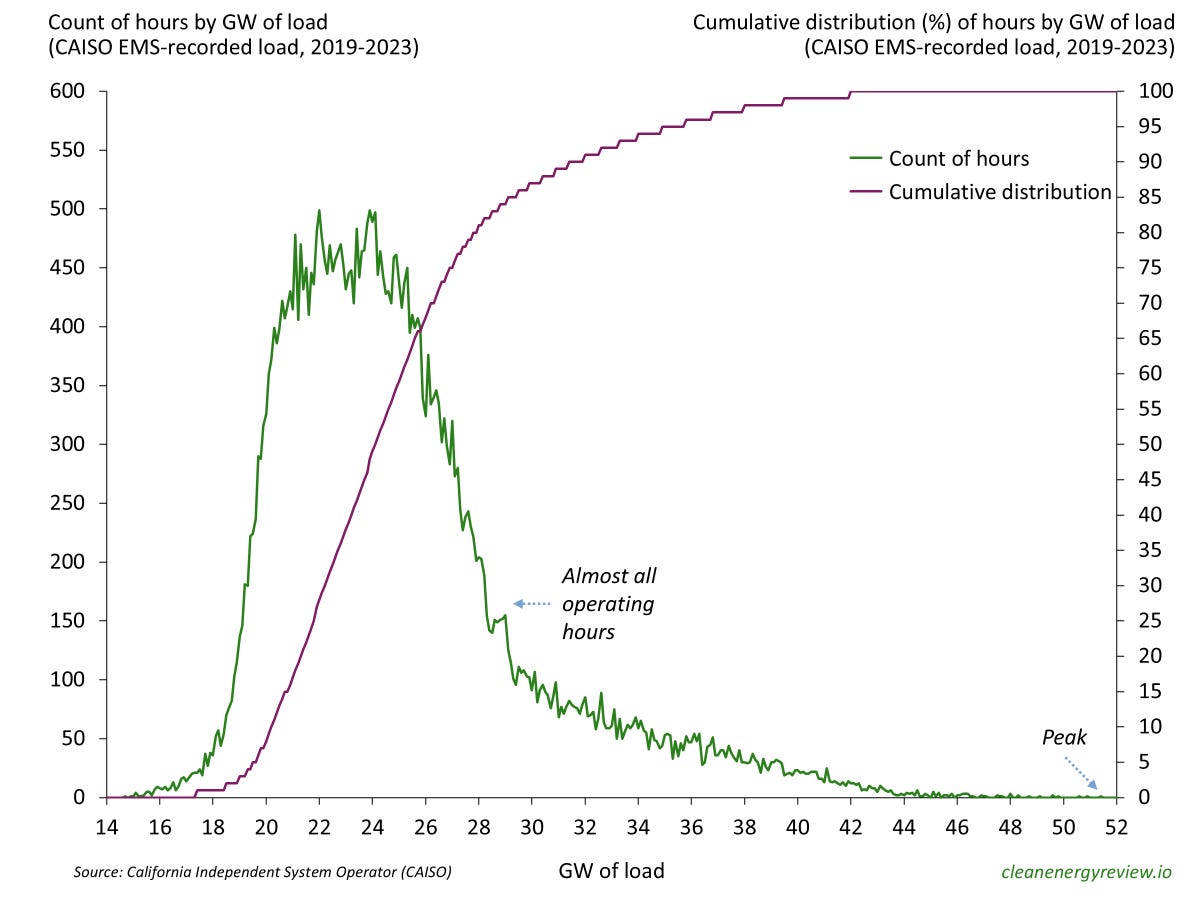

This looks something like the above, which shows the distribution of 5 years of hourly load in California1. ~87% of hours (the line in green) are below 30 GW of load, but there is a fat right tail of extreme outcomes. While ~99% of loads are below 40 GW, the peak on September 6, 2022 reached more than 51 GW.

Historically, these types of spikes have been solved by ‘overbuilding’ capacity, which creates significant costs even when done well. This model is now under increasing strain with the return of load growth and generally rising electricity prices.

But what if there was a way to better use our existing capacity by managing around these peaks?

Enter: distributed energy resources, or DERs

DERs are devices like smart thermostats, home batteries, and electric vehicles whose load or generation can be changed to help manage around peak times.

To be a bit more rigorous, we can define a DER as:

Anything that can change the net load

At a given house or business (behind the meter)

In response to a control signal

This would include2 things like curtailable loads (e.g. smart devices like thermostats, water heaters, stoves, EV chargers) whose demand can be temporarily be lowered around peaks. This also includes batteries (either in EVs or stationary storage) which, with the right equipment, can power other loads in a home or feed power back to the grid.

From these basic building blocks, much can be built to manage around peak periods and lower effective costs.

The earliest examples at consumer scale (first deployed between the 1970’s and 1990’s) were control modules that attached to and could shut off home air conditioners. In return for a small payment or a discount on their electric bill, a consumer might allow a utility to control their A/C a dozen times a year during peak events. Growing up in California, my family saw programs like these as a great way to save money in return for temporary discomfort.

These programs have since matured, and have been effective at shaving the worst of the peak. But customer enrollment is generally expensive, and these programs are limited in how much they can scale up. An air conditioner that pauses most hot afternoons is an air conditioner that doesn’t work.

So what has changed? Why now?

First, there are more DERs than ever before. In 2023 the Department of Energy estimated ~30-60GW of capacity was already deployed, equivalent to ~1% of peak load today. They expect this to grow rapidly, with an estimated ~50-150GW in capacity added each year between 2025-2030.

Second, the load shifting capacity per DER is larger than ever, thanks to EVs in particular. Where a single home air conditioner might be curtailed to save ~1-2 kW of load3, turning off a Level 2 EV charger4 might save ~7-8 kW. If that EV has the capability5 of feeding power back to the house, its large 60+ kWh battery could offset the whole home for hours at a time.

Across DER types, significant capacity is being added, with Wood Mackenzie (an energy data firm) estimating DERs could top ~217GW in potential capacity by 2028 (equivalent to ~30% of current peak load, ~10-20% of the forecast peak).

People are also more likely to agree to these DERs being used. While there’s a direct negative impact to having one’s air conditioning shut off, for most people it is easy to delay charging their EV until later at night or to use their home battery to help support the grid (while still retaining some charge in case of an outage).

Finally, information technology has advanced rapidly. Broad penetration of smartphones, embedded computing (e.g., in vehicles), and wireless networking6 now allow the control and orchestration of these devices in real-time at scale.

Suddenly, we aren’t looking at artisanal programs with great effort expended to enroll customers, install devices, identify peak events, send curtailment signals, and reimburse participants. We have fleets of devices that can shift gigawatts of load at the speed of a push notification.

This is the difference between having to call a cab to your house and hoping it will show up, and using an app to summon a car within minutes, knowing its price upfront and tracking its progress in real time. Not only is the latter a better experience, it is so much better that it gets used much more frequently.

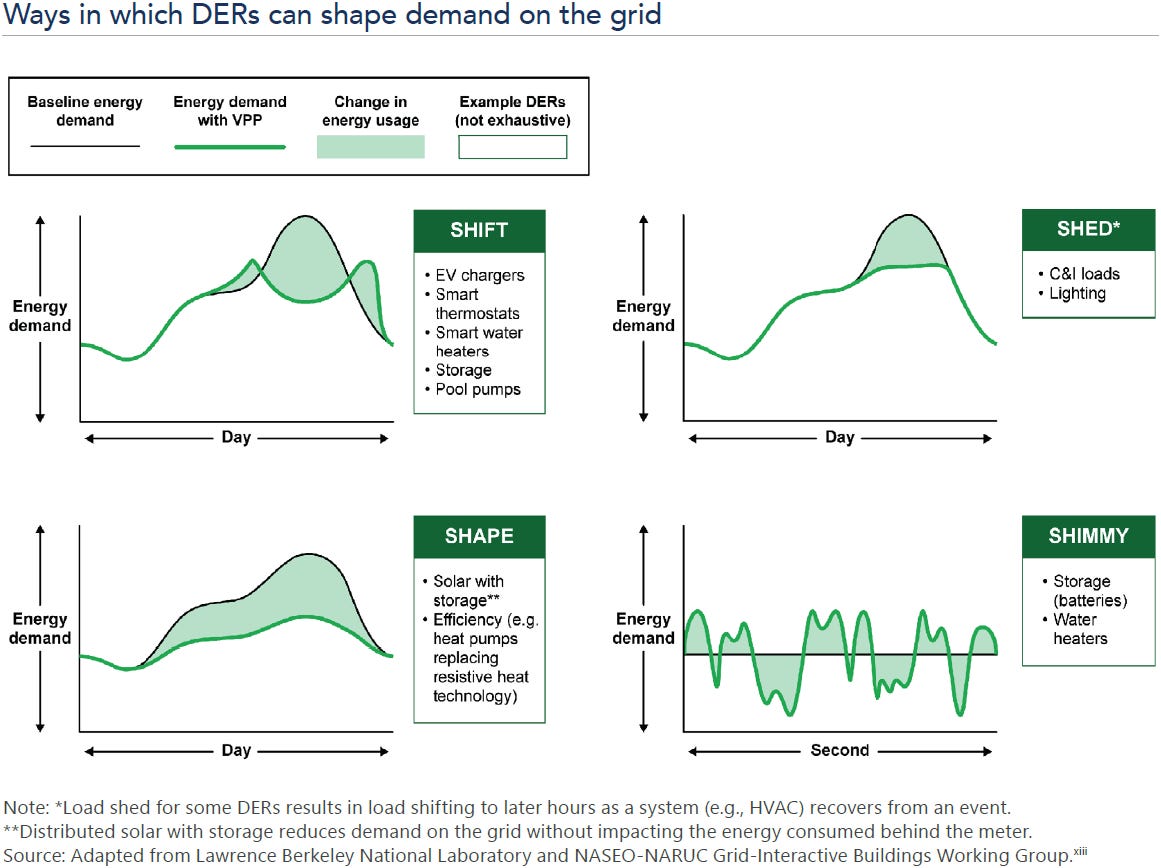

For DERs, this will mean a shift from niche programs to platform-enabled participation in markets. The opportunity thus expands dramatically–from a dozen peak events a year to ongoing activity7 on a day-to-day basis. These activities will vary somewhat by the type of DER, but there is a role to play for each of them.

This variety unlocks a range of new business models built around DERs, with many increasingly focused on aggregation of DERs into ‘virtual power plants’ (VPPs) for market participation.

Even if the basic concept of ‘send signal to DER to help balance grid’ is pretty straightforward, the specifics are already starting to look different across regions depending on their respective regulatory structures.

In relatively deregulated energy markets like Texas, much of the consumer-scale action is taking place among retail energy providers that buy power on wholesale markets to provide to their customers.

In these markets, companies like Octopus Energy and David Energy are enrolling customers that have DERs and controlling those devices as necessary to avoid spikes in wholesale energy prices. This allows them to offer a lower effective cost of energy to their customers, while also helping to stabilize the broader grid during times of stress.

The opportunities for savings here are so dramatic that companies like Base Power and Branch Energy are even willing to front the cost of batteries for their customers as a way to unlock additional DER capacity.

In other markets like California, DER aggregators like Weavegrid and Optiwatt and residential energy companies like Sunrun and Tesla are leading the way. Sunrun for example has sharply increased the portion of their projects that include battery storage, reaching ~54% in Q3 2024. In parallel, Sunrun’s focus on subscription sales (where consumers pay a semi-fixed rate while allowing Sunrun control of installed DERs) allows them more flexibility to optimize the operation of customer DERs on the back-end.

California in particular has also been a promising market for commercial & industrial DERs and microgrids (where a facility might be able to operate islanded from grid power during an outage). This can take different forms, from a basic offering like Voltus’s that mostly leverages existing equipment, through a new microgrid from Scale that aims to offer a net savings on energy costs, to an Enchanted Rock microgrid that uses market participation to offset the cost of backup natural gas generators for critical facilities.

Finally, in regions with full vertical integration–where a single utility controls generation, transmission, distribution, and retail sales–the use of DERs at scale will likely be slower to ripen. While the devices themselves might still be deployed (some people will want EVs regardless), without the right regulatory and economic arrangements in place they will not reach their full potential.

This points to another important parallel with Uber: not everyone will agree on the best regulatory and economic treatment for these new tools. While I don’t think we’ll see the electric equivalent of taxi strikes and rideshare bans, the current veneer of cross-industry agreement could easily crack.

For example, DERs stand to undermine the value of ‘peaker’ plants that currently run a few times a year to support grid peaks. While this might be more economically efficient for the system as a whole, the owners and proponents of those generators are already lobbying against the reliability of DERs and in favor of capacity payments to keep these plants open. Expect to see more lobbying from incumbents around the appropriate use of DERs.

As DERs reach scale, we may also begin to see complaints about their disproportionate use of grid equipment and capacity (rather than the benefits DERs can provide). For example, grid investments may be temporarily concentrated in wealthy neighborhoods that adopt EVs faster, creating a perception that poorer customers are subsidizing the rich. While not always well-founded, these types of arguments have held sway in the past.

In parallel, scale could bring bruising fights between DER providers that echo those fought by Uber against companies like Lyft and DiDi.

The general DER offer structure—where a consumer sees a simple lower rate (or appealing payment), and all the complexity of DER operation is handled on the back-end (within parameters that a customer agrees to)—creates a potential opportunity for commodified price competition. While consumers might benefit from lower prices, as they did with Uber, they might also be unpleasantly surprised by unexpected surge prices8, dead batteries allowed by fine print, or even bankruptcies when providers cut too deep on price.

The regulatory and economic context will need to be rebuilt as these devices get deployed and harnessed, to say nothing of the technical back-end9 required to reliably orchestrate fleets of devices

On net, the results of ‘Uber-ization’ will be massive.

The thoughtful deployment and engagement of DERs will allow us to quell grid peaks, the traditional bane of the electric grid. This will reduce the incremental investments needed to manage load growth, while lowering the effective price of energy across the country. New markets will be unlocked, and upstarts will face down century-old utilities.

The combination of smartphones and apps upended the taxi market; the rise of DERs will fundamentally rewire the provision of electricity.

Big thanks to Rob, Quade, and Steve for reading drafts of this. Any errors or omissions remain my own.

Further reading:

Department of Energy - Pathways to Commercial Liftoff - VPPs

NARUC - Aggregated DERs in 2024

Ryan McEntush (a16z) - Decentralizing the Electric Grid

Lynne Kiesling - Decentralizing the grid

The territory of the California Independent System Operator and the state of California are not fully coterminous, but close enough for our purposes here.

I don’t consider solar generation by itself a DER. While some people refer to them as such, and they are distributed resources that produce energy, on their own they don’t help us much in dealing with peaks. Consistent with the ongoing NY-ISO Grid Flexibility proceedings, I am also excluding energy efficiency upgrades and ‘front-of-the-meter’ assets that interconnect directly with the grid. The former because they are not controllable via signal, the latter because they often fall under different regulatory and economic paradigms (and this is complicated enough without that).

Assuming a central air conditioning system that draws ~3-4kWh and is cycled at ~50% capacity during peak events.

EV chargers are often categorized into levels by their ampacity and voltage. A Level 1 charger is basically a fancy extension cord, and operates at 120V providing ~1-1.8kW of power. Level 2 chargers operate at 240V and provide ~3-19kW of power.

Importantly, this capability is still pretty limited, as I talked about in my piece on vehicle batteries. Only a few vehicles (mostly pickup trucks) have vehicle-to-home or vehicle-to-grid capabilities. Worse, the National Electrical Code (NEC) has not finalized rules for these systems, though there is some expectation this will happen for the 2026 code revisions.

For DERs this mostly means wifi, though some have built in cellular connectivity. The data backhauls used for most ‘smart’ electric meters is too slow / too constrained for real-time monitoring and device control.

E.g., capacity, energy, and grid services markets, depending on what is allowed in that jurisdiction. Self-consumption by the homeowner to offset their own usage during peak hours under a time-of-use rate can also be valuable.

Some have argued that the use of surge pricing—rather than ‘discounts’ off of high prices that were rarely experienced—was an unforced error on Uber’s part given how much people seem to hate even an impression of price gouging. Griddy, a retail energy provider in Texas that went bankrupt due to its pricing model during Winter Storm Uri, shows the risks of exposing consumers too directly to wholesale prices that can ‘surge’.

Seems to me like the main barrier to smart use of DRE is actually VPPs.

If you think about it, the only reason VPPs exist is because it's impossible to participate to electricity markets (wholesale or ancillary) with small assets.

That leads to a whole range of regulatory headaches on how to aggregate these assets.

I feel like just indexing consumers on the spot market (above a certain size of consumption/production) would be the most straightforward way to unlock DREs.