There are only 2 kinds of battery

AA and 9V

Underlying the near-daily drumbeat of announcements and coverage of new and improved energy storage systems, there are really only 2 kinds of battery1 that matter for the grid over the next 20 years:

High capital cost per kWh stored, high roundtrip efficiency

Incremental cost of ~$200-400 per kWh of capacity; roundtrip efficiency of ~80-90%

Useful for daily cycling (or even more frequent for grid services like voltage regulation)

Low capital cost per kWh stored, low roundtrip efficiency

Incremental cost of ~$10-60 per kWh of capacity; roundtrip efficiency of ~30-50%

Useful for any frequency less than daily

Each of these archetypes has a stable demand-pattern that will drive buildouts over the next 20 years. Technologies and products that fall between the two poles will struggle, particularly as teams in within both archetypes race to bring down their cost per installed kW/kWh.

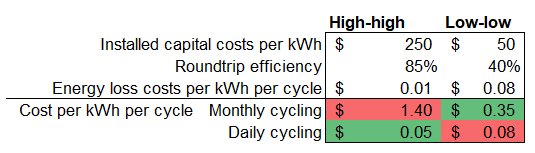

Let’s use an illustrative example to flesh this out. Take two competing energy storage technologies, ‘high-high’ and ‘low-low’ with specs as follows:

High-high: ~$250 installed cost per kWh; ~85% roundtrip efficiency

Low-low: ~$50 installed cost per kWh; ~40% roundtrip efficiency

Similarly, let’s assume each has a useful life of 15 years2, and can serve one of two grid regimes:

Daily cycling [evening peak shaving] (~365x per year, ~5480 cycles within 15 years)

Monthly cycling [multi-day spikes / renewable intermittency] (~12x per year, ~180 cycles within 15 years)

With an energy input cost of ~$0.05 per kWh, we get the following cost per cycled kWh:

As expected, the option with the lowest absolute costs is better when the # of cycles completed is low, but as the # of cycles increases the cost of energy becomes increasingly relevant.

This is consistent with what we see in traditional thermal generation, with less efficient (ideally fully depreciated) simple-cycle gas turbines or oil-fired generation serving a peaking role a handful of times a year.

Extending this across the full range of cycle frequency, we can generate the following:

At ~$0.05 per input kWh, the high efficiency (and high capex) option doesn’t become more cost effective overall3 until we’re doing ~3,000 cycles over a 15 year period (roughly every other day), implying a large range of potential charge / discharge regimes under which the ‘low-low’ technologies are most effective.

At costs of ~$0.02-0.03 per input kWh the low-low option is strictly dominant across the full range (in our simple model), though as will shortly become clear this many cycles isn’t practical with the ‘low-low’ technologies (without eroding their cost advantage).

There is sensitivity within each archetype that affects the specific crossover point, but the takeaway should be that competitive ‘high capex’ technologies will be those targeting daily cycling.

So what are these high-high and low-low technologies, and how do they stack up?

Describing each is beyond the scope of this essay, so I’m just going to list them:

Lithium iron phosphate (LFP)

Lithium nickel manganese cobalt (NMC)

Vanadium redox flow batters (RFBs)

Diabatic compressed air energy storage (CAES)

Pumped storage hydropower (PSH)

Hydrogen energy storage systems (HESS)

Zinc-based batteries (Zinc)

Thermal energy storage (Thermal)

Iron-air batteries (Iron-air)

E.g., Form Energy

Costs and roundtrip efficiencies will be primarily drawn from the Pacific Northwest National Laboratory (PNNL) report here (2022 Grid Energy Storage Technology cost and Performance Assessment). The costs and roundtrip efficiencies for Form’s iron-air battery tech comes from their whitepaper here4.

I’ve excluded the ‘Gravity’ category covered by PNNL, as it’s a bit of a hodge podge of different technologies that are still getting to scale5.

I’ve shown a 10MW / 240 MWh configuration6 to emphasize the dispersion here—it’s really the tipping point between daily cycling of 2-10 hour systems and the 100 hour systems in which the low-low systems increasingly approximate their reservoir costs.

That illustrates the broader point here: these two archetypes form distinct competitive sets. There isn’t one ‘energy storage’ market, there are really two (with any middle that currently exists likely to get eroded from high and low over time).

A couple additional things jump out:

Pumped storage hydro is great, if you’ve got the geology to get a reservoir at PNNL’s estimate of ~$60 per kWh

Unfortunately, this likely isn’t as realistic an option in enough places / at the scale required

Similar story for HESS and CAES: if you can get a cavern for ~$5-15 per kWh, then great!

Form’s iron-air technology seems more promising here if only for its modularity / scalability

Thermal storage is in an interesting potential ‘middle’ position.

It’s got low-ish reservoir costs that make it cost effective for cycling frequently, but may get squeezed by increasingly-cheap LFP batteries at shorter durations and ‘low-low’ tech at long durations.

Everything in the top right that isn’t LFP will likely get squeezed

The ‘high-high’ category is maturing quickly. There are gigawatts of installed capacity at this point, and proven market success for providing grid services and arbitraging intra-day price variations through high power / low energy chemical batteries (e.g., LFP). In geographies like Texas and California, these are getting built seemingly as fast as they can get permitted. Technologies are racing down the learning curve, with LFP likely to win in the medium term absent some sort of disruption.

The ‘low-low’ category is more nascent. With existing hydrocarbon-based peaking capacity, the role for these assets hasn’t fully matured yet7.

Form Energy in particular has been working across the US to develop region-specific studies showing why long-duration storage (including their 100-hour batteries) are a valuable part of a low carbon energy portfolio (see: California, New England, New York, Minnesota / Wisconsin).

For the other ‘low-low’ technologies like HESS / CAES / PSH, it’s not clear how binding constraints of geology / geography will be on reservoir costs and siting. I’d expect to see increasing project activity here, but perhaps not at the same frequency as more modular offering like Form8. There is likely a market opportunity for additional low capital cost chemistries / technologies that can better achieve modularity / scalability for this use case.

So where does that leave us:

There are two types of batteries that matter (high capex / high efficiency and low capex / low efficiency)

As energy gets increasingly cheap, roundtrip efficiencies matter less and capital costs matter more, creating a role for super cheap low efficiency tech

Opportunities exist for daily cycling (high capex) and less-than-daily cycling (low capex)

Technologies / teams in both categories will be pushing to lower their respective costs, no one is standing still

Expect modularity and repeatability of designs and projects to be a key differentiator in driving down costs

Renewables + batteries are the future of electricity

When paired with cheap generation (e.g., solar) these technologies are mature / cheap enough now (and in the future) that the trend will only be towards more displacement of hydrocarbon generation

We’re really just arguing about pace and specific technology winners at this point

I’m going to use the term battery in the colloquial sense, rather than endless repetitions of energy storage system (and variants thereof), recognizing that not all ESS’s (e.g., gravity storage) are batteries in the strict sense.

Yes, a number of technologies have claimed useful lives of ~30-60 years, higher than that of ~10-20 years (dependent on cycling patterns) for traditional chemical batteries (e.g., LFP, lead-acid). This is not answer changing for our purposes here, but becomes more relevant in choosing within archetypal categories when developing a specific project (though if your tech only pays off in years 20-40, it will struggle to scale fast enough to beat LFP down the learning curve).

For simplicity, we’ll also ignore lifetime degradation, depth of discharge effects, ongoing O&M costs, and end of life salvage value, though these are similarly relevant within archetypes.

On a nominal cost basis. None of this takes into account discount / hurdle rates that would further strengthen the case for technologies with lower upfront costs.

For the ‘2021’ costs I’m giving Form’s iron-air technology the (potentially too generous) assumption that their storage block costs are ~$20 per kWh (this is labeled as their 2030 cost, not something they’ve already achieved) along with another ~$1,000 per kW across the whole project.

Energy Vault’s brick-based system is the furthest along, but it’s hard to tell how much to believe the high efficiency / low capex they report to PNNL.

This configuration isn’t specifically modelled in the PNNL report for all relevant technologies. Where necessary implied costs have been interpolated based on scaling per kW and per kWh costs.

Though extreme events like Winter Storm Uri do provide stark reminders of the impacts of multi-day generation outages.

The exception could be hydrogen energy storage systems (HESS). There is so much money flowing into hydrogen now thanks to the IRA / hydrogen hub funding that non-geologic storage costs may come down enough to make this work in more modular setups.