The promise of hot bricks

Decarbonizing industrial heat

Imagine a toaster and a blast furnace had a baby, and that baby was the key to decarbonizing the production of everything from paper to polyethylene.

Enter: thermal batteries.

In this piece, I’ll talk about what they are, why they’re compelling, and where they’ll likely gain traction first.

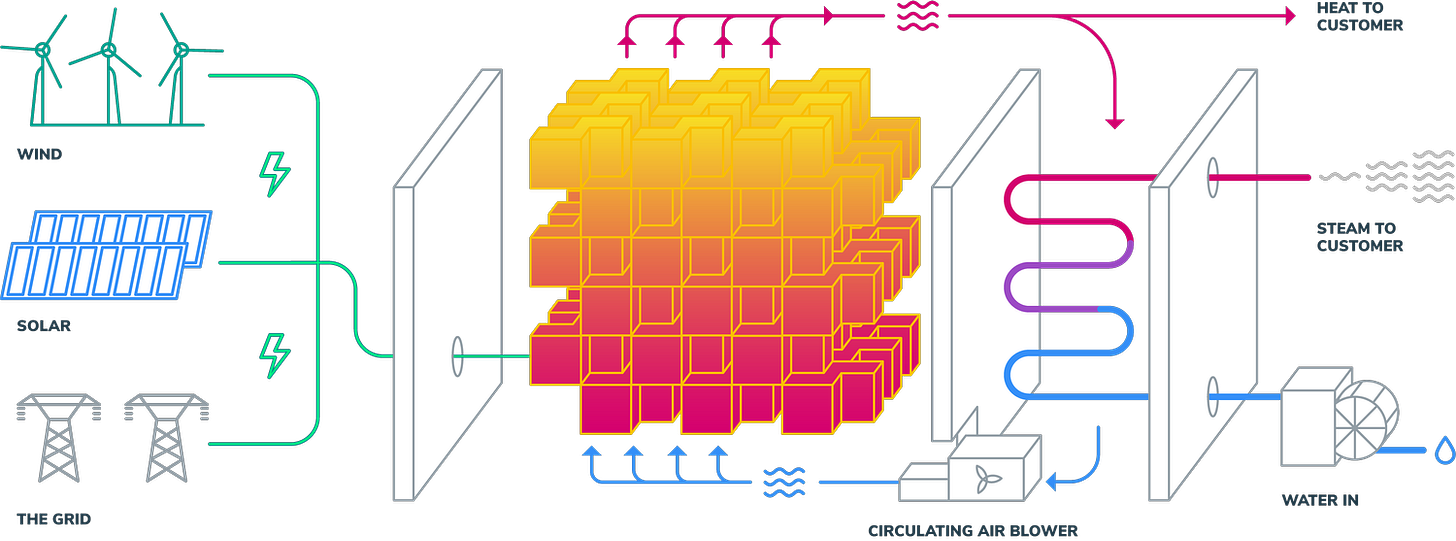

Thermal batteries1, like those produced by Rondo and Antora Energy, use resistive electrical heat (toaster wire) and large thermal masses (bricks2) to supply zero-carbon heat for industrial uses. They can charge up when electricity is plentiful and prices are low, and can discharge over time to supply steady heat3 to industrial facilities. No longer must we rely on big gas boilers for paper manufacturing and cracking hydrocarbons in a refinery, nor gas furnaces for metal smelting and cement calcination.

This matters because right now this industrial process heat is a major contributor of greenhouse gas emissions, accounting for 7-9%4 of the US’s 2022 emissions, and up to ~17% globally. These emissions have been seen as otherwise hard to abate, given the high cost of alternatives.

Direct electrification is challenging, because the 24/7 electricity many industrial facilities need is expensive (and emissions intensive without some form of storage). For example, assuming ~$0.07 per kWh electricity and ~$5.00 per MMBtu for natural gas5, and 100% and 75%6 efficiency respectively, just the energy costs of outputting 1MWhth in heat would be ~$70 with electricity but only ~$23 with gas.

Heat pumps (which compress and expand refrigerant to shift heat rather than create it) are more efficient7, but they can’t reach the high temperatures needed for many industrial processes. Available models can reach up to a max temperature of ~165 Celsius, but ~80-100C is more common. This leaves a gap for the ~70% of process heat needed at temperatures above ~100C.

Source: Energy Innovation Policy & Technology - Thermal Batteries

Thermal batteries help solve both of these problems.

First, they can achieve much higher temperatures than heat pumps. Antora claims an achieved temperature of 1,800C, while Rondo is targeting delivered heat of 1,500C. The upper bound here is generally in the heat transfer equipment8; the bricks themselves are very stable over repeated cycles. These temperatures are a big improvement over what is possible with heat pumps, even if limits remain for applications at very high temperatures (e.g., metal smelting).

Source: Rondo

Second, thermal batteries can be charged when electricity prices are low, reducing their effective cost of electricity. They can charge up during the day or late at night while avoiding peak evening periods9, helping stabilize the grid while reducing their effective cost of energy. In parallel, they steadily discharge to provide heat. One analysis by Energy Innovation found that this optimized charging could lower the effective cost of electricity per MWh by ~55-65%.

This dance works because the roundtrip efficiency of thermal batteries is high at ~95%+ (due to slow heat losses), and the cost per unit of storage media is relatively low at ~$5-20 per kWh (a fraction of the cost of lithium ion cells).

This creates a compelling path to decarbonizing industrial process heat.

So, given all these benefits, why don’t we hear more about mass deployment of these systems?

While I believe that wave is coming, the economics of these projects are just starting to work.

We can think of project viability in terms of:

Cost of electricity versus natural gas

Electricity price volatility (intraday, interday)

Subsidies / taxes

Site-level constraints

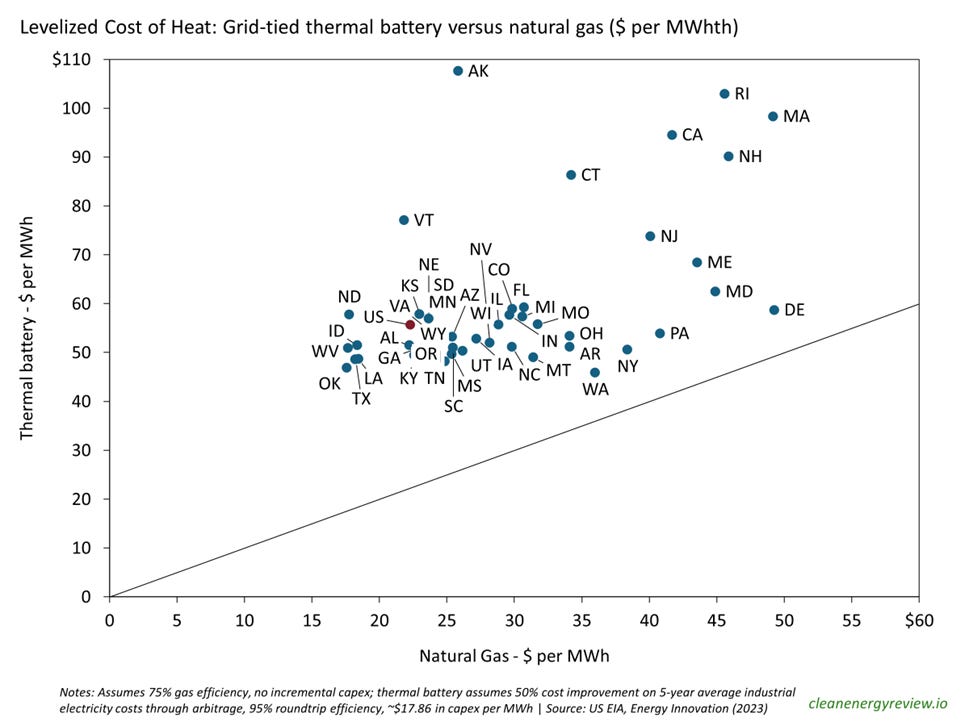

Starting with only the relative cost of energy, we can see how different US states fare as potential targets for thermal batteries. Even assuming a 50% reduction in effective electricity prices through arbitrage, and 75% efficiency for natural gas, only a few states10 currently see thermal batteries breakeven on a pure energy cost basis.

For example, Washington (in the bottom right of the chart) has relatively cheap hydroelectricity and relatively expensive natural gas. This makes thermal batteries potentially viable on a cost of energy basis11 (below the line in the chart). By contrast, California (top right of the chart) has more expensive natural gas and much more expensive electricity, making it a less appealing target for thermal batteries without subsidies.

Once we factor in the ~$18.00 per MWhth cost12 of the thermal battery system itself, and the grid-tie to power it, no states appear economically viable without subsidies.

So thermal batteries aren’t (yet) cost competitive given low prevailing gas prices in the US, but they are MUCH more appealing in Europe, where the cost of gas is higher.

Predictably, this is where we see many of the first announced projects landing, with Rondo developing 3 customer sites across the EU13. The Europeans will likely get most of the hot brick action in the near-term.

That said, this input price comparison only gets us part of the way there. Solar and wind generation, and the intermittent energy they create, will be the real driving force for thermal battery adoption.

Solar and wind are intermittent resources, meaning their outputs fluctuate and can’t on their own be dispatched to follow changing grid loads. On a sunny day, solar output might be high but it will be zero in the evenings when loads may be peaking due to a mix of residential and industrial demand . Similarly, there may be periods in spring when wind and solar output is high but seasonal heating and cooling loads are muted.

These swings have even brought about something previously unthinkable: negative electricity prices. For wind and solar plants, the marginal cost of producing power is effectively zero. At the same time, there are thermal plants that ‘must run’ because they are necessary for grid stability or because they can’t ramp up and down quickly. Add in some transmission congestion and friction in day-ahead markets14, and the last few years have seen recurring low and even negative prices when loads are low and renewable generation is high.

Source: EU Agency for the Cooperation of Energy Regulators

This pattern of intermittent low or even negative electricity prices15 at least some of the time creates prime opportunities for thermal batteries.

As renewables penetration increases, hot bricks can and should be there to soak up the incremental low cost generation. There is even the potential to run these systems ‘off-grid’16 with direct ties to solar PV or wind plants. While this would require overbuilding capacity to deal with output fluctuations, the ongoing cost declines for renewables make this increasingly viable.

Here too, Europe may have the edge. Their high average electricity prices are partially downstream of their high natural gas prices. When looking at just energy from renewables, the EU has much more globally competitive electricity costs. Thermal batteries will take advantage of the resulting price volatility (or off-grid installations) to drive down the cost of decarbonized industrial heat.

The pace of deployment will be further affected by subsidies (or carbon taxes) that incentivize the decarbonization of heat. This includes the 45X subsidy in the US (still being finalized17) which could reduce thermal battery costs by up to ~$45 per kWh of battery capacity. The EU has its own supports18, with funding through entities like the European Investment Bank (EIB) helping finance early projects.

The introduction of carbon pricing, or carbon border adjustments, would provide further incentives to switch away from hydrocarbon-generated heat.

Finally, assuming favorable high-level economics, the viability of any specific project will come down to site-level nuances.

The first projects will likely be retrofits to existing facilities. This will bring in site-level infrastructure constraints around existing heat systems, which will require varying degrees of modifications to accept heat from a thermal battery. A thornier problem could be the available headroom on grid connections19; charging these batteries requires a lot of electricity and if grid upgrades are required that could slow projects down by years.

Over the medium term, I expect we’ll see purpose-built plants designed around thermal batteries with off-grid renewable resources set up just to convert sunlight and wind into industrial heat.

But where does that leave the US?

Blessed as we are with low cost natural gas, thermal batteries are not yet obvious winners on purely economic terms. While subsidies will help, the declining cost of solar PV (and to a lesser extent wind) will likely dictate the pace of deployment here.

This makes the southwest and the central wind belt the hot brick hot spots.

Source: National Renewable Energy Laboratory

Source: US EIA

These are the regions where I’d expect to see thermal batteries get traction first. California and Texas in particular already have high solar penetration, with the latter adding capacity quickly, creating daily price fluctuations that thermal batteries can harness.

So: industrial process heat has long been seen as hard to decarbonize, but hot bricks are going to change that. While the economics don’t currently pencil out everywhere, they work in enough places for the technology to get proven out and start making a difference for decarbonization.

Expect a quiet revolution in industrial heat over the next 10-20 years.

Further reading:

Austin Vernon - The Case for Brick Thermal Storage

Energy Innovation - Industrial Thermal Batteries

International Energy Agency (IEA) - Heat

Thanks to Rob, Shreeda, Ben, Grant, Steve, Riad, and Katie for reading drafts of this. All errors or lapses in judgment are my own.

Thermal energy storage is a relatively capacious category. I am going to focus in this piece specifically on sensible heat storage where heat is stored in thermal masses at high temperatures. This is distinct from latent or thermochemical heat storage technologies that respectively rely on phase transitions or reversible chemical reactions to absorb / release heat.

I’m using the term brick relatively loosely here. While Rondo does use refractory bricks, Antora’s systems rely on carbon blocks. Other sensible thermal energy storage systems rely on things like crushed gravel or even liquid media like molten salts.

Antora is also developing thermophotovoltaics to translate the stored heat back into electricity, though I won’t focus on that use case / feature here.

The industrial sector comprises ~23-30% of US greenhouse gas emissions depending on treatment of electricity generated off-site for industrial use. ~30% of industrial GHGs are attributable to process heat. To the extent thermal batteries can produce steam for other on-site uses (e.g., machine drive, HVAC) its decarbonization impact would be even larger.

This roughly reflects the 5-year average industrial prices paid across the US according to the US EIA. Later in the post, we’ll look at how these figures vary by region.

The generation of process heat has varying efficiencies, from ~90% for advanced steam boilers with condensate recovery to ~40% for industrial furnaces without a heat recovery loop. The DOE estimates a third of process heat is lost as waste, so ~75% efficiency slightly favors natural gas in this example.

Heat pumps can often achieve a Coefficient of Performance (COP) above 1, meaning thermal output above the electricity input. Industrial heaters boosting temperatures by 60C can see a COP of around 3, significantly reducing the cost of electricity relative to traditional resistive heating. Efficiency tends to go down as the temperature differential increases, which plagues both residential air source heat pumps in cold climates and industrial heat pumps trying to reach high temperatures.

At really high temperatures, the whole system gets more expensive as specialty materials become necessary. Even if solutions might be technically possible they may not be economical.

The ability of a thermal battery to respond to these price swings is defined by its input power (charge rate) relative to output power (discharge rate), and its thermal capacity (rated in MWh). The optimal design will vary based on the relative cost of power equipment versus storage medium and on expected price volatility, but generic systems might see an input ratio of 2-6x and a storage duration of ~24-96 hours.

This and other state-level charts exclude Hawaii. It is an extreme outlier in both electricity and natural gas costs, and does not have a large industrial base, so I’ve simplified the visuals by removing them. Given their strong solar resource there may be value in select Hawaiian deployments of thermal batteries.

In practice, Washington’s surfeit of hydroelectricity also dampens, so the arbitrage benefits of thermal batteries are likely overstated in this simplistic analysis.

These estimates are drawn from work by Energy Innovation, which includes ~$40 per kW for power equipment, ~$10 per kWh for storage, ~$5 per MWh for grid connections, and a 7% discount rate. The target system had 24hrs of storage and a 3.5x power ratio. Early projects will likely have both higher costs and higher variance in costs.

In addition to its initial commercial plant in California.

There can be an operational cost to curtailing generation, as well as meaningful price differences between nodes alongside transmission congestion, that leads to negative price dynamics.

Though it remains to be seen how long these arbitrage opportunities will persist given the rapid deployment of electrochemical energy storage (read: lithium ion batteries).

These systems need not be truly disconnected from the grid, but may rely primarily on direct connections to renewables with a grid-tie in case of shortfalls. Project specifics will guide whether overbuilding or a backup grid-tie are more economical.

This comes from section 13502 of the Inflation Reduction Act which establishes the Advanced Manufacturing Production Credit. The initial IRS guidance establishes that the credit does apply to thermal batteries, but the ratio of thermal capacity to electrical capacity for credit purposes has not been established.

The US has tended to use the tax code to implement subsidies around renewables while the EU has used more project specific vehicles like loan guarantees. I don’t have an opinion on which is more effective, but the former is superficially more transparent.

If a thermal battery with a 7MWth output has a 3x power ratio, it would need a 21MW grid connection. This is a lot of incremental power, and may not be immediately available (or require an expensive upgrade) depending on the specifics of the site.