Residential solar is not ending

The real impacts of NEM 3.0

From the mainstream news coverage, one might be forgiven for believing that California’s shift to Net Energy Metering “3.0” was the death knell for residential solar in the state.

In practice, it led to a short-term decline in installations as installers and potential buyers adjusted to the new rate structures, but it will make the market healthier over the long term.

To oversimplify, under NEM 2.0 homeowners with residential solar could feed excess power generated back into the grid and be compensated at their retail rate.

This approach had the benefit of being simple for customers to understand, but was not a particularly accurate reflection of the value being produced (or not) by this energy. In particular, this meant (increasingly) overcompensating solar owners for net power produced on normal sunny afternoons (when solar is plentiful and kWhs are cheap), without addressing their early evening ‘peak’ usage (which drives most grid infrastructure costs).

NEM 3.0 aims to address these issues by shifting (for new solar installations) from an export rate based on retail rates to those based on an ‘Avoided Cost Calculator’ (ACC). This ‘Avoided Cost’ is meant to more closely match the underlying energy costs, which in practice are significantly lower1 than retail rates.

In expectation this has the effect of:

Increasing the relative value to customers of zeroing out one’s normal consumption, rather than feeding power back to the grid

You’d rather avoid an incremental ~$0.60 per kWh at 6pm than feed back that same kWh as excess for ~$0.03 at 3pm

Increasing the value of feeding back power during select peak times during the year (basically, evenings in August / September)

The peak export rates are sufficiently high that it’s better to export than offset part peak consumption later that night

What would we expect to happen here?

Solar-only systems are mainly valuable to the extent that they can offset time-matched power usage

This could lead to more optimized sizing of systems to match a home’s expected daytime consumption, rather than the previously profitable strategy of ‘as big as the roof will allow’

In practice, given the high balance of system / soft costs for residential solar, marginal solar-only systems are less likely to get deployed (relative to NEM 2.0)

Solar+battery systems maintain their relative value

Batteries sized for daily cycling to smooth home consumption (but not necessarily feed-in to the grid) become relatively more valuable

V2G capabilities become particularly compelling as large sources of power that can be deployed a few times a year

The cost per cycle (in reduced vehicle usefulness / resale value from reduced capacity) may make daily cycling of car batteries for grid support less compelling

So, what would you need to believe for this to be a good idea?

Stand-alone residential solar isn’t uniquely useful as a grid asset

Given high solar curtailment at the grid level, we don’t need more solar power in the mid-afternoon, we need more carbon-free power in the evening

On the margin, netting out more consumption behind the meter has the same impact as more exports; we shouldn’t favor the latter

Residential solar is differentially owned by wealthy homeowners

To the extent that NEM 2.0 over-compensated afternoon solar feed-in, it represented a regressive transfer

Residential solar under NEM 2.0 was so popular / such a good deal that we risked creating net flow at the circuit and B-substation level, something for which the grid isn’t (yet) designed

Many circuits started to reach capacity for incremental solar before this change

What would you need to believe for this to be a bad idea?

This shift will advantage big installers / solar companies who have the expertise and relationships to sell PV+BESS packages

This is totally valid, but I don’t think is a huge concern long term. People are already adapting and getting down the learning curve on this.

Residential solar is the only way for us to deploy renewable energy at scale due to long interconnection queues / timelines

This is partially right, but neglects the fact that we can do this better when paired with batteries

The new lower non-peak rates are not accurate reflections of the value created by decentralized solar production; we will underbuild relative to optimal

I think people overestimate the value of decentralized resources per se, to the extent that generation is happening at times when there isn’t much net load.

Let’s make this more concrete with a worked example, based on my sister’s house in Riverside County (I’m told she’s had a bunch of door knocks from solar installers since moving in last year).

First, we can take a look at what the payoff would have looked like under NEM 2.0. Assuming an installed cost of ~$3.50 per watt and utilization of ~16%2 with a useful life of 20 years, our cost per kWh is ~$0.12. Similarly, we can assume our ‘off-peak’ retail rate is ~$0.30 per kWh for a net benefit of ~$0.18 per kWh.

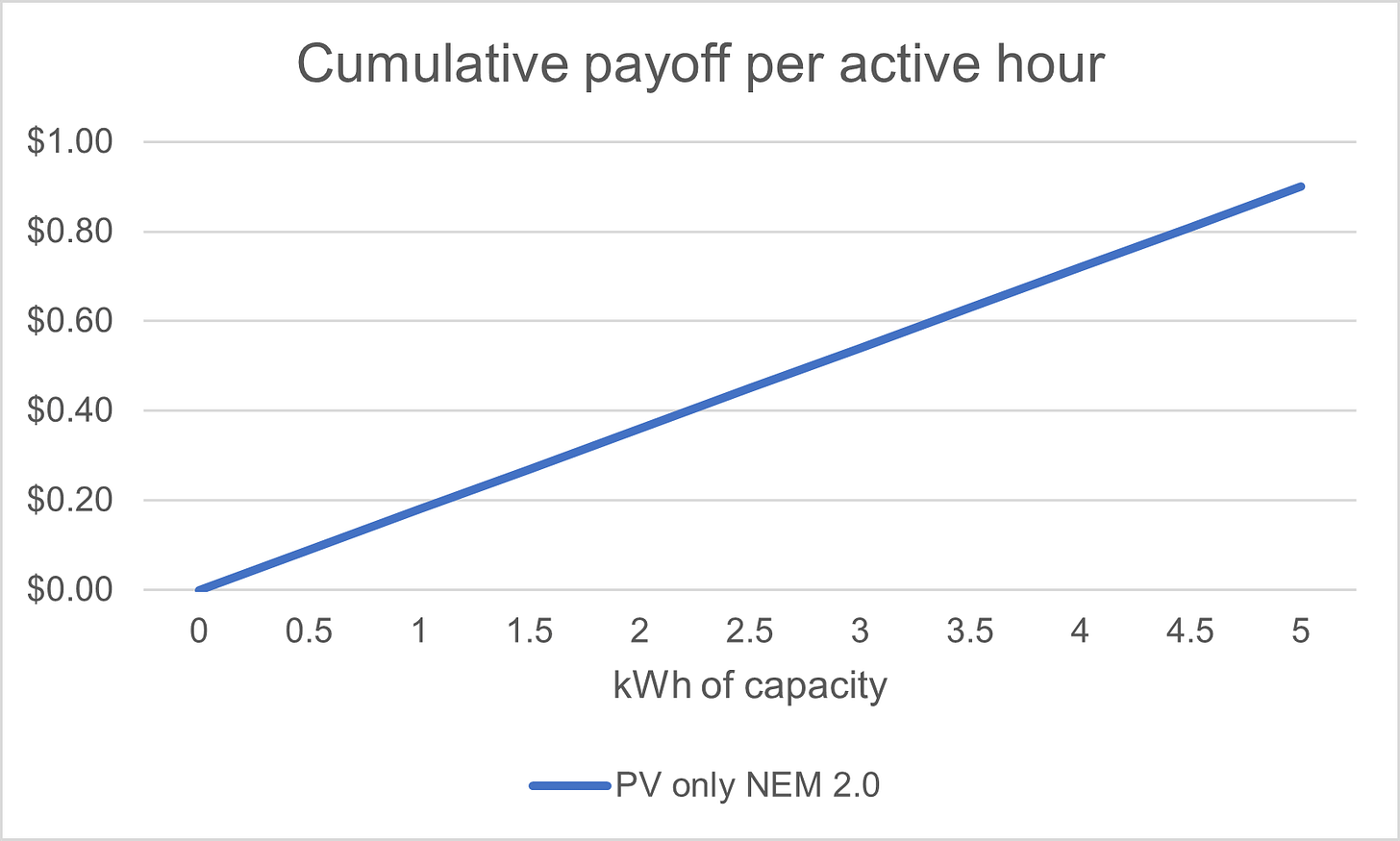

Conveniently, a utilization of ~16% implies the solar array is active for ~4 hours per day at full capacity3, allowing us to simply but usefully compare systems. For example, the payoff curve under NEM 2.0 would look approximately like this:

Across ~1,460 ‘active hours’ per year, a system with ~3 kWh of levelized output would generate ~$0.55 per active hour, for a total of ~$800 in net benefits.

The shape of this payoff implies a strategy of sizing to the maximum the roof could hold (or that the customer could afford), with no diminishing returns to array size. This also implies a free money bonanza for solar installers and their customers, at the expense of non-solar ratepayers, given that these rates are far above the costs of the next best generation source (also solar, just utility-scale).

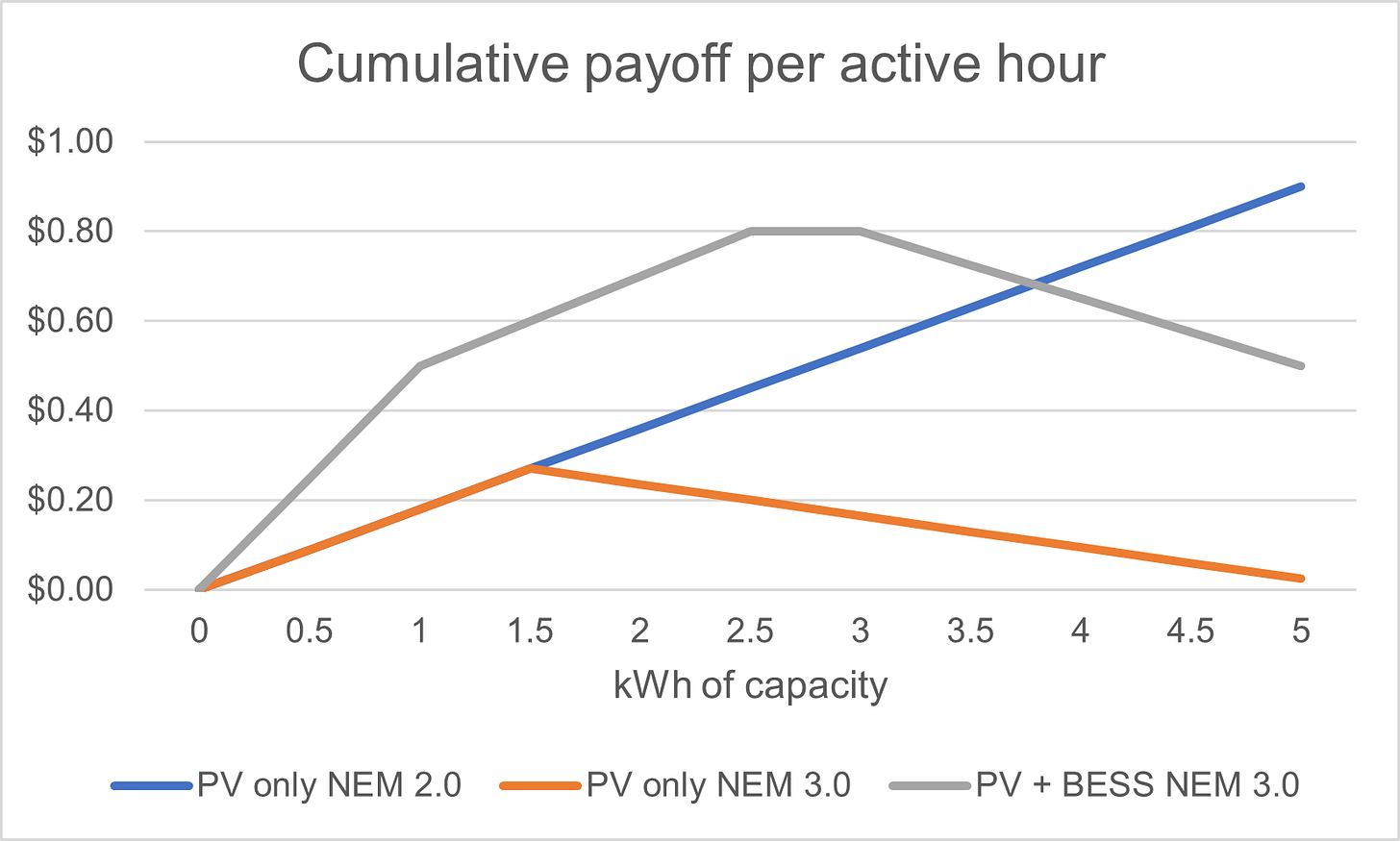

Enter NEM 3.0. Assuming for this off-peak hour we can only be reimbursed for exports at ~$0.05 per kWh, we are destroying ~$0.07 in value for every kWh of capacity above and beyond what the household would be consuming.

The value of our ~3 kWh levelized output would have dropped from ~$800 per year to ~$250.

Thankfully, batteries solve this, creating value for both homeowners and for the grid when paired with solar PV systems.

If we assume we can install a battery energy storage system (BESS) for ~$850 per kWh4, and cycle it daily for ~10 years5, then we get a cost per cycled kWh of ~$0.26. Once we add in the ~$0.14 per kWh for solar to charge the battery (~$0.12 per kWh less roundtrip energy losses), we’ve cost ourselves ~$0.40 per kWh for our troubles.

On it’s face this is expensive, but California peak rates are higher still. Assuming ~$0.60 for usage during peak periods, we are saving ~$0.20 per internally consumed kWh with our system.

Under these conditions, the size of the system will be optimally constrained by:

The volume of household consumption during peak 4-9pm periods

E.g., if we don’t have an EV and are only consuming ~1.2 kW per hour in the 5-hour evening window, then a ~6 kWh battery is all we need.

The cost per cycle is higher than the off-peak rate, so we see little value in avoiding consumption there (unless we want to fully defect from the grid to avoid fixed charges).

The # of hours when the ACC export rates are above ~$0.40 (or even above our retail rates)

Based on the CPUC rate forecasts here, there are ~240 hours in 2026 with export rates above ~$0.40, at an average hourly rate of ~$0.90, spread across ~60 days

This is sufficiently small that it doesn’t really make sense to size the system against these windows (at least at the residential level), but does create a nice kicker for the BESS system (or eventually V2G)

From this we can work backwards to size the system based on the size of battery needed to cover evening consumption, and the size of the PV array to cover daytime consumption and charge the battery.

In this specific example, that likely means a ~3 kW array paired with a ~6.5 kWh battery, for a payback curve that looks something like the below (with a steeper start to account for the select hours each year with high export rates) representing annual net benefits of ~$1,200.

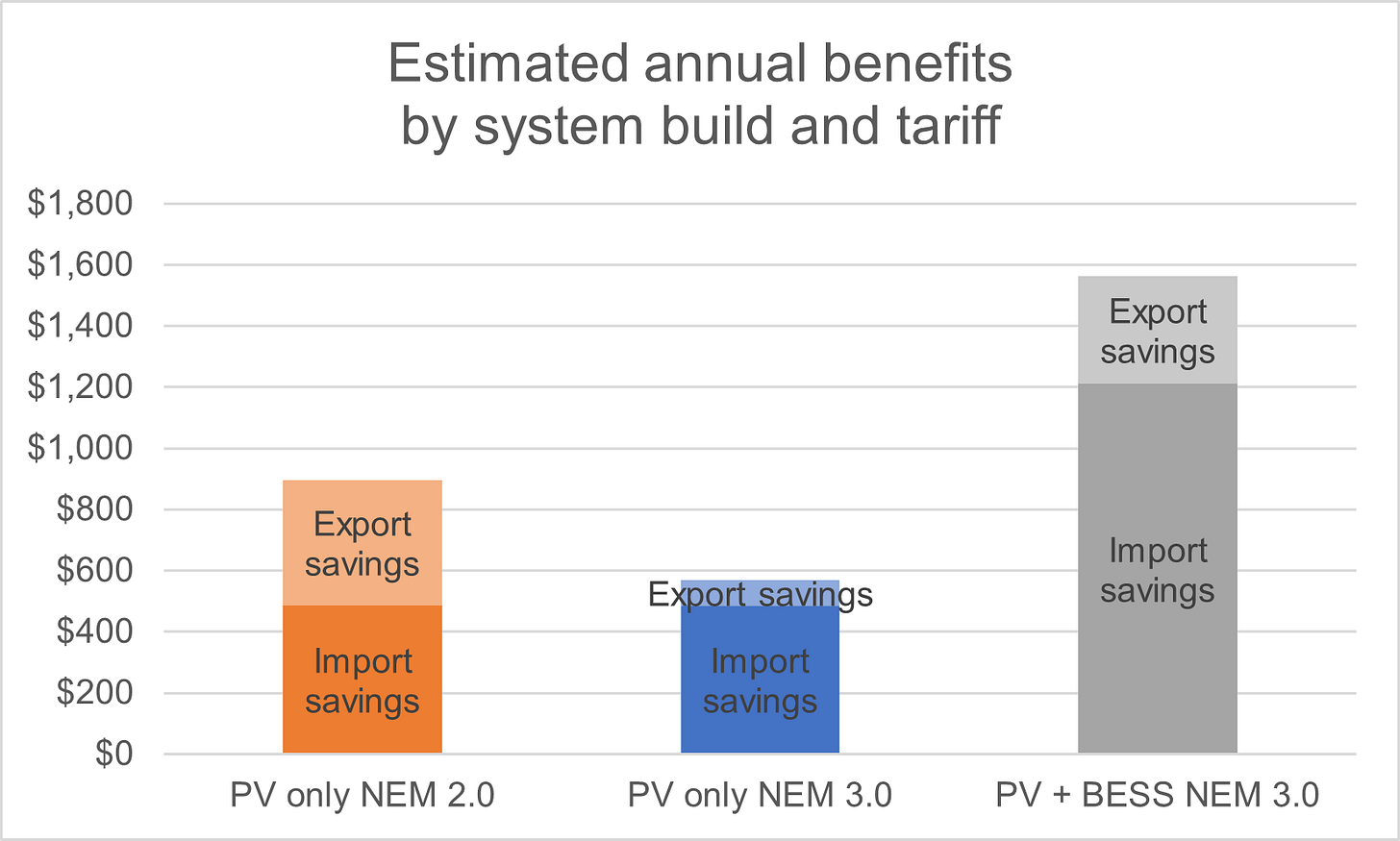

To check this result, we can develop a comparable system using OpenSolar, with PV+inverter costs of ~$10,000 and battery costs of ~$6,000 (as applicable), before a ~30% production tax credit (PTC). For simplicity, we won’t model the degradation in panels / batteries, nor the increase in retail rates expected over the life of the system.

We’ve got to back into the NEM 2.0 rates (since those are no longer hosted in their system), but the results are as follows:

Importantly, across all builds and tariffs the bulk of savings are coming from avoided Imports, even under NEM 2.0. Though the BESS system does appear able to arbitrage those specific high Export rate hours under NEM 3.0, this is not the main driver of value for customers.

Obviously the PV + BESS system is more expensive, but looking at the Internal Rates of Return (which account for the upfront cos) tell a similar story:

All of which to say, yes the shift to NEM 3.0 turfed the value of PV-only systems, but there is still significant value in installing a PV + BESS system under NEM 3.0. Batteries are even getting cheap enough to be valuable to existing residential PV households that are looking to avoid high peak rates.

This is a healthy change that sets up the next phase of growth for distributed energy management within California. While there were short-term adjustment costs, these were necessary to put the system on a more sustainable trajectory given the relentless cost declines in solar and battery systems.

Over the medium term, the market will normalize, and the solar installer industry associations will move on from griping about this.

This is particularly true during mid-afternoon when solar is active, and most folks put the average export rate under the ACC at ~$0.05-0.08 per kWh. The ACC also excludes distribution cost charges that show up on many bills as a subcomponent of the volumetric rate.

This embeds the conversion from nameplate DC to AC produced. Unless otherwise noted, all energy values are AC equivalents.

In practice it’d be active for ~8+ hours per day at less than full capacity, but this simplification isn’t answer changing for our purposes.

Incidentally, this is pretty expensive relative to the cost of the underlying battery. One can buy a ~60kWh battery in the form of a Tesla Model 3 for ~$40,000, which comes to ~$667 per kWh of capacity and includes a free car! Expect this to come down markedly as the residential BESS installation market gets more mature and competitive, or gets replaced by V2H usage.

Assuming a cycle only uses ~90% of total capacity to avoid damage. E.g. for a ~6.5 kWh BESS we would only use 6 kWh per cycle. Assumes ~3,650 cycles achieved over 10 years, does not account for battery degradation nor useful life / salvage value after 10 years.