The battery wave is already here

We just can't access it

When do you think California will have enough battery storage to fully shave off its summer evening peak and smash its ‘duck curve’?

2030? 2035? 2045?

What if I told those batteries are already deployed, they just can’t be used? That’s the situation the Golden State finds itself in with its growing population of electric vehicles.

There are more than a million EVs in California, together comprising more than ~60 gigawatt hours of storage. Those batteries are effectively siloed today, unable to be used for anything but driving.

But once EVs start getting built with bi-directional charging capabilities, huge amounts of additional storage will be created every year, unlocking radical benefits for individual customers and for the system as a whole.

Where we are today

There are ~30 million light-duty passenger vehicles on California’s roads today (per the California Energy Commission). At the end of 2023, ~1.5 million (~5%) of those were ‘zero-emission vehicles’ (ZEVs).

There are two types of ZEVs1, battery-electric vehicles (BEVs) like the Tesla Model 3 and plug-in hybrid electric vehicles (PHEVs) like the Toyota Prius Prime. BEVs have no combustion engine and run entirely on battery power, PHEVs have a smaller battery pack with a combustion engine to generate additional electricity for longer trips.

There were ~1.1M BEVs in California at the end of last year, and ~0.4M PHEVs.

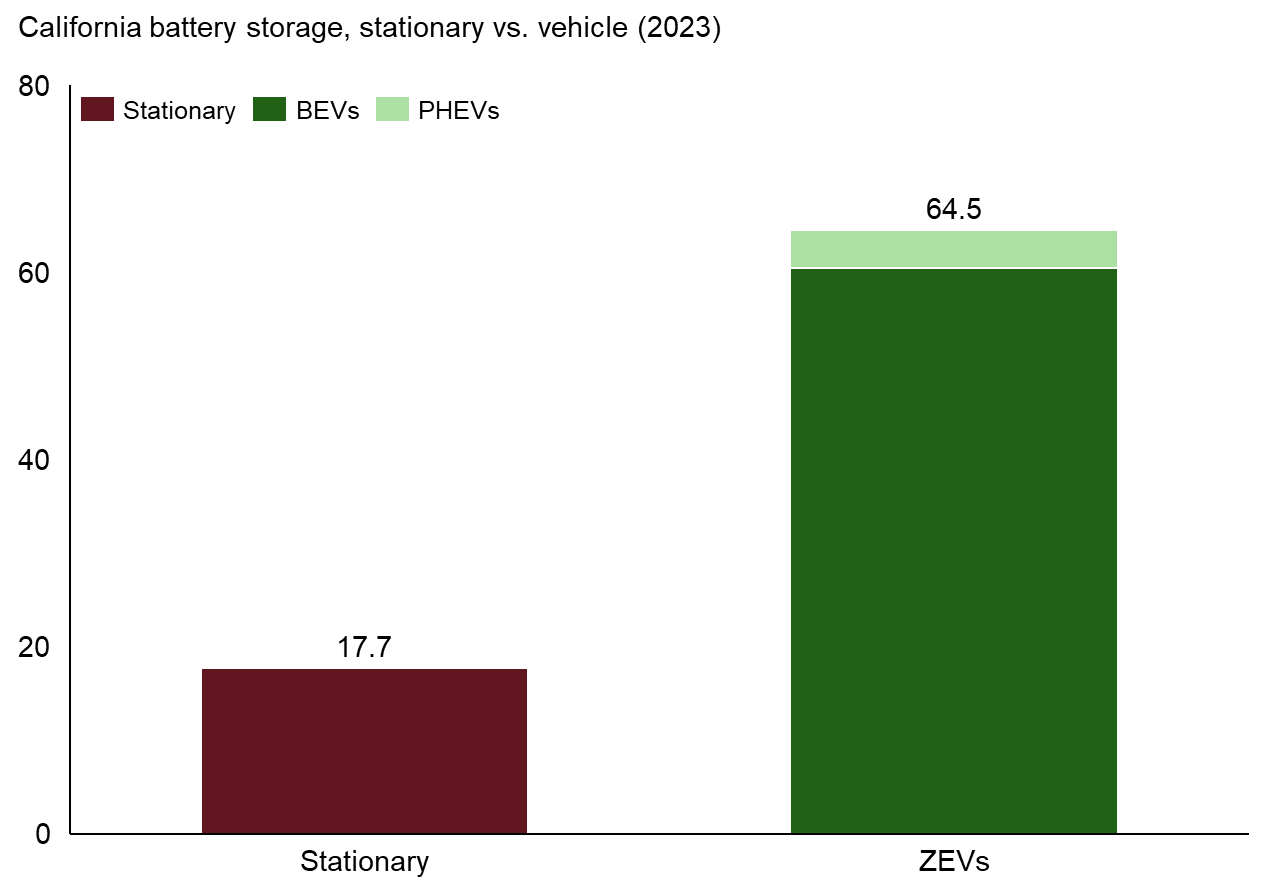

If we assume a ~55 kilowatt-hour (kWh) battery pack for the BEVs (roughly in line with a Tesla Model 3) and a ~10kWh battery pack for the PHEVs (roughly in line with the Prius Prime), that equates to ~65 GWh of battery capacity in California EVs.

This is a huge amount of capacity.

As of May 2023, the stationary battery fleet within the territory of the California independent system operator (CAISO) was ~17.7 GWh, just ~27% of what these vehicles represent.

The highest instantaneous load ever experienced by CAISO peaked at ~52.061 GW, on September 6, 2022 at ~4:57pm. The load for that hour peaked at ~51.5 GWh, or ~80% of the theoretical capacity of these batteries2.

Where we are headed

This year, CAISO is expected to gain ~6.8 GW / 27 GWh3 of stationary batteries.

By comparison, ZEVs comprised ~24% of new car sales for Q1 2024 at just over ~100k vehicles. Annualizing this implies an additional ~19 GWh of vehicle-based battery capacity, bringing the total to ~84 GWh.

CAISO is aiming to hit at least ~23 GW / ~121 GWh of battery storage by 2035 (though given the current rapid pace of additions this could easily be surpassed).

If ZEVs reach ~35% penetration by that point (when they will be required to be 100% of new sales in CA), they would represent ~450 GWh of storage capacity.

At full ZEV penetration, the ~30 million light-duty vehicles in California would represent ~1,300 GWh of energy storage capacity4, enough to power 2023’s average load of ~25 GW for ~50+ hours.

This is a huge amount of potential storage, an amount that doesn’t seem to be fully recognized by all the relevant grid participants.

They’re still cars, not BESS with wheels

At this point, you may be rightfully thinking that these are cars, and need to be used as such. Owners may not want to run down their batteries to zero to serve the grid. Totally fair!

The average driver travels ~40 miles per day. Assuming a ~240 mile range for our model BEV, this would consume ~9 kWh per day5. If we want to always maintain ~2 days worth of driving capacity, we would only be able to use ~37 kWh (~67%) of our ~55 kWh battery as storage capacity.

If we further assume the PHEV capacity is wholly dedicated to driving, current ZEV penetration implies ~40 GWh of available storage capacity in light-duty vehicles (versus ~64.5 GWh total capacity). At full potential, this would drop our available capacity from 1,300 GWh to 800 GWh (‘only’ ~32 hours of capacity at 2023 average load).

The bigger challenge is what it means to charge all these zero-emission vehicles that are driving ~40 miles per day.

This is not much of an issue just yet6. Our ~1.5M ZEVs using ~9kWh per day only add ~13.5 GWh of load per day, or less than 3% of the average daily load in 2023.

At 35% penetration in 2035 (in-line with the math above), this would imply a necessarily larger load impact of ~95 GWh per day (a ~16% increase over the 2023 average). At full ZEV penetration, the average daily load would be fully 50% higher (from ~600 GWh per day to ~900 GWh per day). All this in a industry that has seen effectively no load growth over the last 20 years.

Even worse is the uncertainty around when these cars will get charged. If everyone gets home from work at 6pm and plugs in their EV to recharge without constraints, the grid is going to swiftly and unceremoniously break.

This is a potential nightmare for utilities, and is the focus of ‘managed charging’ startups like Weavegrid, ev.energy, and EnergyHub. They are working with utilities, OEMs, and drivers to set up the software and process infrastructure to levelize EV charging to avoid creating load spikes (and reduce charging load during peaks).

This is also the target of more standard measures like Time-of-Use (TOU) rates where customers pay more per kWh consumed during evening peak hours than (for example) during the middle of the day when solar output is peaking.

So, these cars represent a huge risk to the grid if their charging all lands at the same time, and it is this risk that most people are currently focused on. This will get solved in the medium-term, it is the opportunity to leverage this storage capacity to proactively smooth load throughout the day that is the most exciting.

This is how we shift cheap solar from the middle of the day to all hours of the night. And we get a car thrown in for our troubles.

What’s holding us back?

The risk from EV charging are well known in the industry (at least in places like California); folks are actively working to manage this. The storage potential is huge but there are some key gaps that will need to be overcome for the potential to be realized:

Hardware layer: It is one thing to control an EV to moderate its own charging, its another to be able to feed energy from that EV back into a home (V2H) or back to the grid (V2G).

Very few EVs currently have the hardware to be able to do this, with the Ford F-150 Lightning and Tesla Cybertruck being notable examples. This is the biggest barrier today, and why we don’t see positive grid impacts from so many GWh of storage already deployed.

Many OEMs and utilities are performing pilots and testing these capabilities, and these should start to bear fruit soon. Given their leading position, a shift from Tesla7 (which they’ve started with the Cybertruck) could be a big momentum boost here.

On the charger side, there are further incremental requirements, with a bi-directional charger needed to effectively act as an inverter to feed AC power to the home service panel. This may also require more complicated electrical work at the home, depending on the current state of their panel and the local utility / regulatory environment8.

Making these changes will add incremental cost to these systems, but these costs are not game-changers relative to the cost of the battery.

Software layer: It is not obvious (at least to me) who should ‘own’ the behind-the-meter energy management system (EMS) that coordinates the charging / discharging of a vehicle battery alongside all the other loads in a home. It’s not enough just to have the necessary hardware in place, particularly given the importance of charging / discharging behavior in maximizing battery usage and value.

As mentioned, there are ‘managed charging’ startups that are building systems to orchestrate vehicle charging on behalf of utilities. This could seemingly be extended to handle the discharge behaviors from those same vehicles.

There are also residential solar companies like Sunrun that are now working to position themselves as ‘VPP companies’ to reflect their control over customer-side loads and storage through the EMS that comes with the systems they install (and may have contractual rights to control).

Finally there are companies like Span and Lunar Energy that are building software-enabled smart service panels that link with solar panels, storage, and vehicle charges along with allowing the orchestration of loads on a circuit-by-circuit basis within the home.

In the medium-term, I expect multiple providers to 'solve’ the software layers once the hardware capabilities exist for V2H / V2G power flows from BEVs.

Market structures / incentives: The cost of cycling EV batteries to support home or grid loads is not zero. Beyond the round-trip energy losses, there is battery degradation and loss of battery flexibility that vehicle owners would want to be compensated for.

That said, the jump in retail time-of-use rates between peak and off-peak rates (e.g, $0.25 to $0.61 per kWh9) already make this cycling worthwhile to support behind-the-meter loads (i.e. at your house), as I outlined here. Summer peak rates in California are very high, and EV-based energy storage can reliably help individual consumers manage their own exposure to these high prices.

Importantly, exports to the grid are not required to take advantage of this. Grid export has been a key issue (and focus area) for various bi-directional charging programs, but is overestimated in terms of its long-term importance relatively to offsetting behind-the-meter load.

In areas without TOU rates, the incentive structures will be much more muted and specific demand-response (DR) programs will likely be needed to capture the value of this storage capacity. Historically, retail capacity from these types of programs has been small (and/or expensive) relative to commercial & industrial DR programs.

Inertia / ‘customer experience’: Most customers don’t actually want to think about electricity this much. They would like their bill to be low and their appliances (and car) to work when they need them.

Most don’t want to participate in DR programs where someone else controls their battery, and EV OEMs are mindful of the customer implications if a car doesn’t work when and if it’s needed.

The key will be in making this as simple as possible for consumers to ‘set and forget’. TOU rates and an energy management system (EMS) should allow for this, with the customer setting up their preferences and guardrails at key life events (e.g., new car, new solar panels) and allowing the EMS to optimize energy usage in the background.

If the incentive is there, enough people will participate to make a big dent in peak loads behind-the-meter even without 100% adoption.

What could this unlock?

At scale, this has the potential to reshape how the grid should operate in places like California.

Solar panels—at residential, community, and utility scales—will charge EVs and other storage during the day to be discharged as needed during the evening hours and into the morning before the sun comes back up. Increasing EV penetration will supercharge the storage capacity available to serve this purpose, allowing for much higher solar (and wind) penetration across the system.

Dependent on the relative mix and location of stationary and EV-based storage, this could even avoid major grid upgrades through better utilization of existing system capacity throughout the day. In parallel, overall energy use will continue to grow, allowing for increased spreading of fixed system costs, lowering volumetric rates per kWh.

EV batteries will be a hugely important resource to decarbonizing the energy system, their potential just needs to be realized.

Thank you to Jason Crawford and Heike Larson for the conversation that led to this post. Any errors / omissions are entirely my own.

I am going to ignore the ~14,000 fuel-cell electric vehicles (FCEVs) in California. Their deployed count is currently too low to be a meaningful part of the discussion.

Currently, most stationary battery systems are designed to be discharged over 2-8 hours, with 4 hours being most common. EVs can discharge faster when driving (the Model 3 motors are rated at 250 kW relative to their ~55 kWh batteries) though not when they are discharging through their charging cable.

Assuming these are all 4-hour batteries. The CAISO data unhelpfully focuses on power ‘capacity’ in GW rather than energy capacity in GWh.

This assumes the split of BEVs and PHEVs and battery capacities will be similar to today.

These assumptions are directionally correct, though most manufacturers aim for slightly higher range even at the cost of larger batteries. For example, the standard Model 3 has a stated range of ~275 miles from their ~57.5 kWh battery. The most extreme example is the Hummer which has a ~210 kWh battery and has a range of xxx miles.

Though there are upgrade challenges on specific distribution circuits where folks like Tesla and Electrify America want to add lots of fast chargers.

In the past, Elon Musk has downplayed the value of V2H capabilities, given the potential customer impacts of e.g. a customer unplugging the EV that’s powering their home. When paired with some amount of storage like a Powerwall this becomes much less of an issue.

For example, utilities might require a disconnect switch to manage flow back onto the grid for safety and protection engineering reasons.

Taken from SCE’s TOU-D-Prime rate, which is targeted at EV owners and includes lower off-peak rates / higher peak rates.